For the last 5 years, many people believed that CPG e-commerce would be dominated by an Amazon-like model based on fulfillment from warehouses. This deeply impacted their organization, ways of working and analytics.

However, shoppers were already omnichannel, looking for a seamless experience between online and offline. Forward-looking retailers like Target and Walmart understood that the digitization of their stores would be an asset in the war against Amazon by answering shopper demand while limiting last mile delivery costs. This opportunity was also seized upon by startups like Instacart and Shipt.

Then Covid hit, and the effect has, of course, been seismic. At the height of the pandemic, 41% of online US grocery shoppers were first-time users. Even though there has been a downtick since then, a tipping point has been reached and CPGs are following the path other sectors took at this stage of e-commerce maturity. Online grocery is on the rise. Due to factors like convenience and recurring purchase, e-grocery appears to be stickier than just about every other online category.

“As usual, shopper demand dictated, and retailers adapted their model. Now brands urgently need to reshape their business if they want to succeed.”

-Yacine Terki, Data Impact

In this omnichannel world, consumer touchpoints are not centralized. Each shopper selects her or his online store and has a unique experience in the store that has been selected. For example, depending on the Walmart the shopper selects among nearly 4 000 e-stores, the product, prices, promotions, sponsored products and visibility of the products are different from other online Walmart stores. Hence, the shopping experience is different and the products added to the basket are too. This complexity creates discrepancies in how the product is displayed, priced and listed. Consistent, accurate execution is basically impossible for brands across so many online stores without the right partners.

CPGs are faced with sweeping changes. The omnichannel transition is impacting how they’re organized, their ways of working and their need for analytics.

Organization: the journey to omnichannel

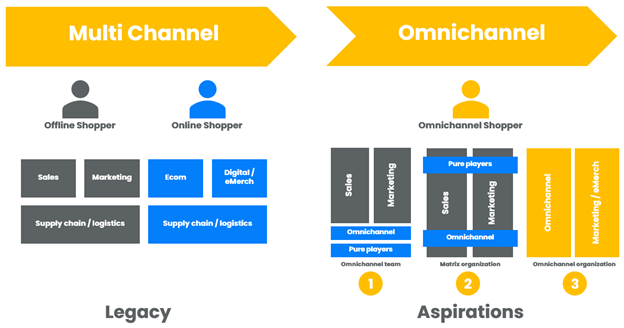

The existing organization of most large CPG manufacturers isn’t built for the omni environment. CPG manufacturers were structured for the Amazon model with dedicated pure player teams, not omni teams. The main challenge for those organizations now is removing or limiting the silos between online business and brick and mortar. Some CPGs have responded to this by creating new roles like Omnichannel Manager to facilitate new workflows. Others have instituted cross-functionality in teams to ensure coordination between channels. The ideal organization isn’t identical for all companies. The transition can be seen as a journey because the shift to full omnichannel organization can’t be immediate. The shift is a long-term project with a lot of change management and the first step is the creation of a team of experts that will lead the transformation.

Fig 1 – Illustration of organizational shift

Source: Data Impact

Ways of working: agility is king

The market is changing daily, making it difficult to predict what might come next. CPGs that can be agile and entrepreneurial are at an advantage. A test and learn approach is necessary to lead. Testing different ways of working is the only solution to define which ones fit the organization. It can be quite valuable partnering with retailers and third parties to co-create and build expertise together.

Analytics: digital shelf is not enough anymore

When the market was dominated by a pure player model, large CPG companies equipped their teams with digital shelf analytics. Now, with the shift to omnichannel store-based e-commerce, the market is becoming much more granular and complex. The increasing complexity of the marketplace has made reliable data analytics essential. The digital shelf is only a very limited part of the needed capabilities and it is mandatory to go beyond that and cover availability, assortment and e-retail media. Brands must see what shoppers see to understand their performance and optimize execution. A culture of data must be embedded in day-to-day processes.

“It’s not possible to properly measure performance or to take appropriate action without exhaustive, location-based analytics. More than being inaccurate, sample-based data is damaging.”

-Yacine Terki, Data Impact

The granularity that exhaustive data analysis offers is the only way to respond to issues and anticipate opportunities. Only data that is gathered from each individual e-store and then rendered in one simple visualization is reliable. Sample-based data is so misleading it often isn’t even directional.

In conclusion, there are several challenges facing CPGs right now, and the willingness to commit to digitization and experiment with emerging technologies, approaches and partnerships will equip them to be competitive and continue to capitalize on the acceleration that took place in 2020. CPGs need to invest in proactive and creative online activities fueled by effective omnichannel capabilities to keep pace with the omnishopper.