Editor’s note: This article is a free, one-time preview of The Food Institute’s new Premium articles, which will be available to members. To join FI, click here.

Comparative analytics platform Social Standards took a look into public consumer posts on Instagram to identify trends within plant-based food conversations. This is what they found:

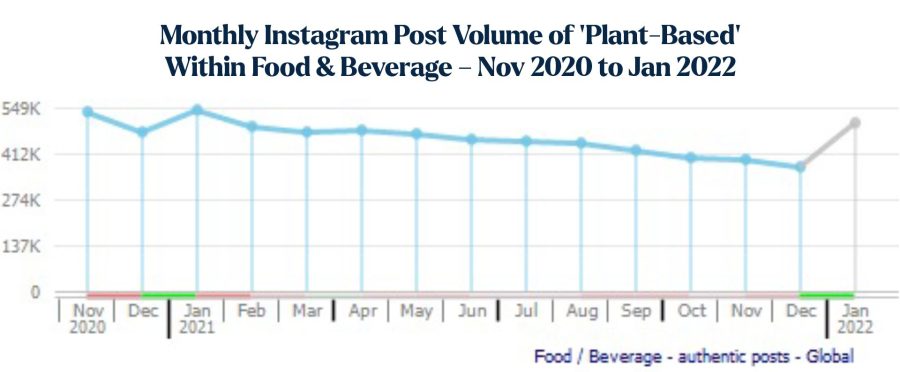

Over the last 12 months, overall, plant based has been declining in conversations on Instagram, but within the last month specifically (January 2022), there’s been an uptick.

The plant-based milk product that has grown the most in consumer conversations on Instagram within the last three months is non-dairy creamer. Hemp milk and creamer in general have also grown, but not as strongly as non-dairy creamer. All other milk products have declined over the past three months.

The strongest growth within the more general category of plant-based dairy products over the last three months is within non-dairy creamer, but other areas that are trending upwards include vegan chocolate, hemp milk, non-dairy butter, cheese and cream cheese. Looking back over six months, non-dairy butter has been the strongest.

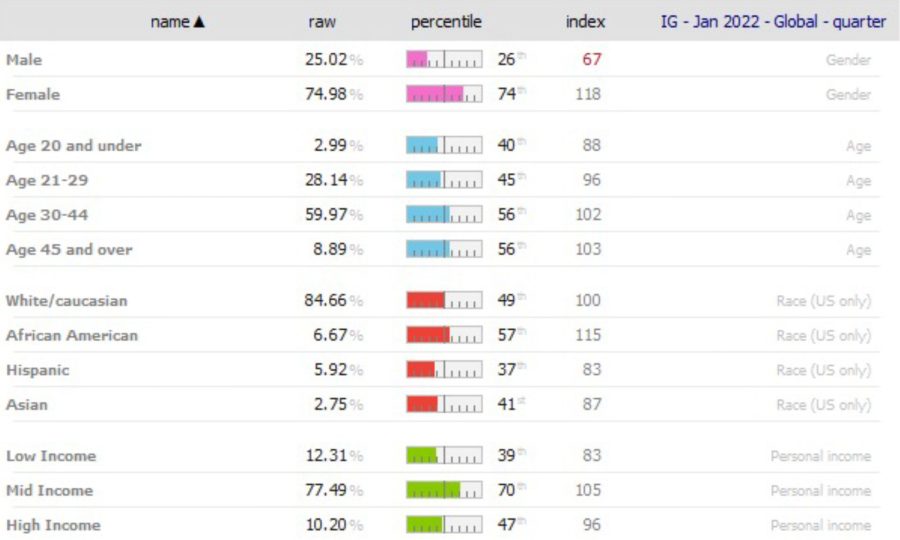

The plant-based conversation does not seem to have much differentiation within generational cohorts. There’s a slight older skew, with people Ages 30+ speaking more about plant-based, but not by much more than expectation. Just looking at frequency of posts (raw penetration percentage), Ages 30-44 are the most interested in plant-based (at 59.97% of the conversion) with 20 and under the least interested (2.99% of the conversation). Women speak more about plant-based than men do, with only 24% of women speaking more about other topics within Food & Beverage. Individuals in the mid-income range also speak more about plant-based than either those with low or high income.

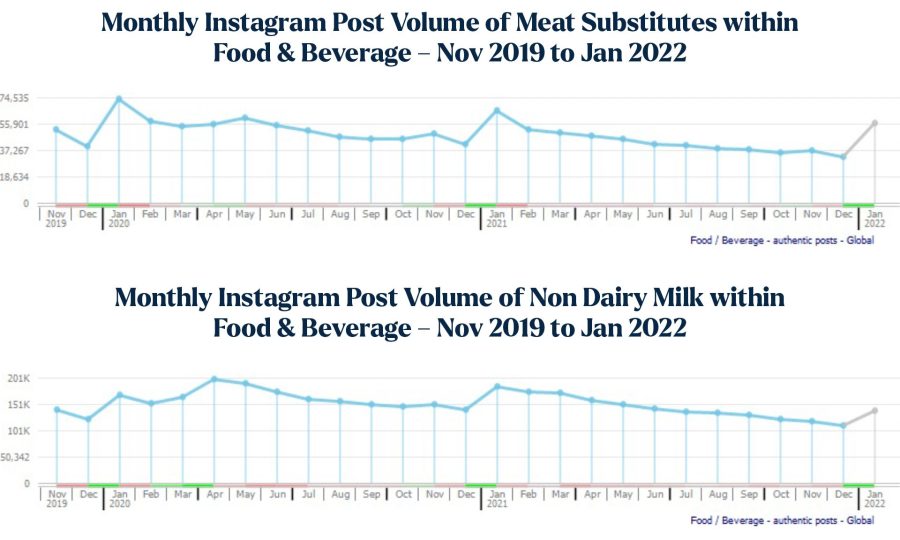

Within the last 26 months, both conversations around meat substitutes and non-dairy milk have been declining. We see a slight uptick on both in January, perhaps pointing towards consumer resolutions to eat healthier in the New Year, but overall there has been a general decline of plant-based conversations over the past two years.

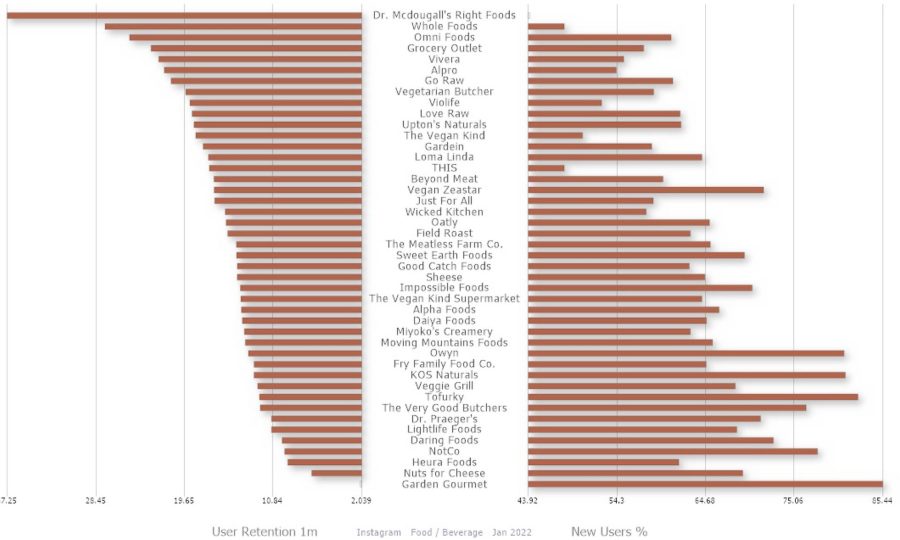

What is interesting is that brands associated with plant-based seem to be either able to easily attract new consumers or they have loyal consumers, but not both. The brands with bars more skewed to the left are retaining their users (consumers) month over month, while the brands with bars more skewed to the right are attracting more new users. Larger, more well-known brands like Beyond Meat, Oatly and Impossible Foods (towards the center of the graph) are able to do both, indicating a more balanced ability to attract new consumers and retain brand loyalty.

Areas within plant-based where there’s been growth have been in herbal medicine, alternative medicine, skincare and detox, indicating rather than just dietary interest, consumers are looking to plant-based for broader benefits and concerns.

Social Standards is a comparative analytics platform transforming billions of social data points into benchmarked insights about every brand, product, feature, and trend consumers talk about. The platform combines the accuracy of quantitative methodologies with the detail of qualitative reporting at the speed of online search to provide consumer forecasting and the “why” behind consumer behavior. Social Standards provides the authentic consumer voice structured into a syndicated dataset with a sample size of millions that is objective, non-biased and benchmarked against the entirety of the market.