Plant-based restaurants that try to mimic the McDonalds’ and Burger Kings of the world may be missing the point that true vegetarians and vegans have little interest in meat-like offerings while those who frequent burger joints have little interest in what are viewed as healthier alternatives, experts told The Food Institute.

A recent case in point is Stalk & Spade, which closed its three locations in the Minneapolis area. In a social media post, the chain cited waning consumer interest in plant-based meat alternatives, as well as supply chain issues and other factors. The chain had offered vegan takes on burgers, fried chicken sandwiches and milkshakes in the hopes of luring vegetarians, vegans and omnivores.

In Massachusetts, Clover Food Lab, which has 12 locations, filed for Chapter 11 bankruptcy protection, unable to drum up financing for a planned expansion after revenue forecasts proved overly optimistic, Restaurant Business reported (Nov. 6). Among the other chains that have retrenched was Veggie Grill, which closed a dozen of its 29 locations.

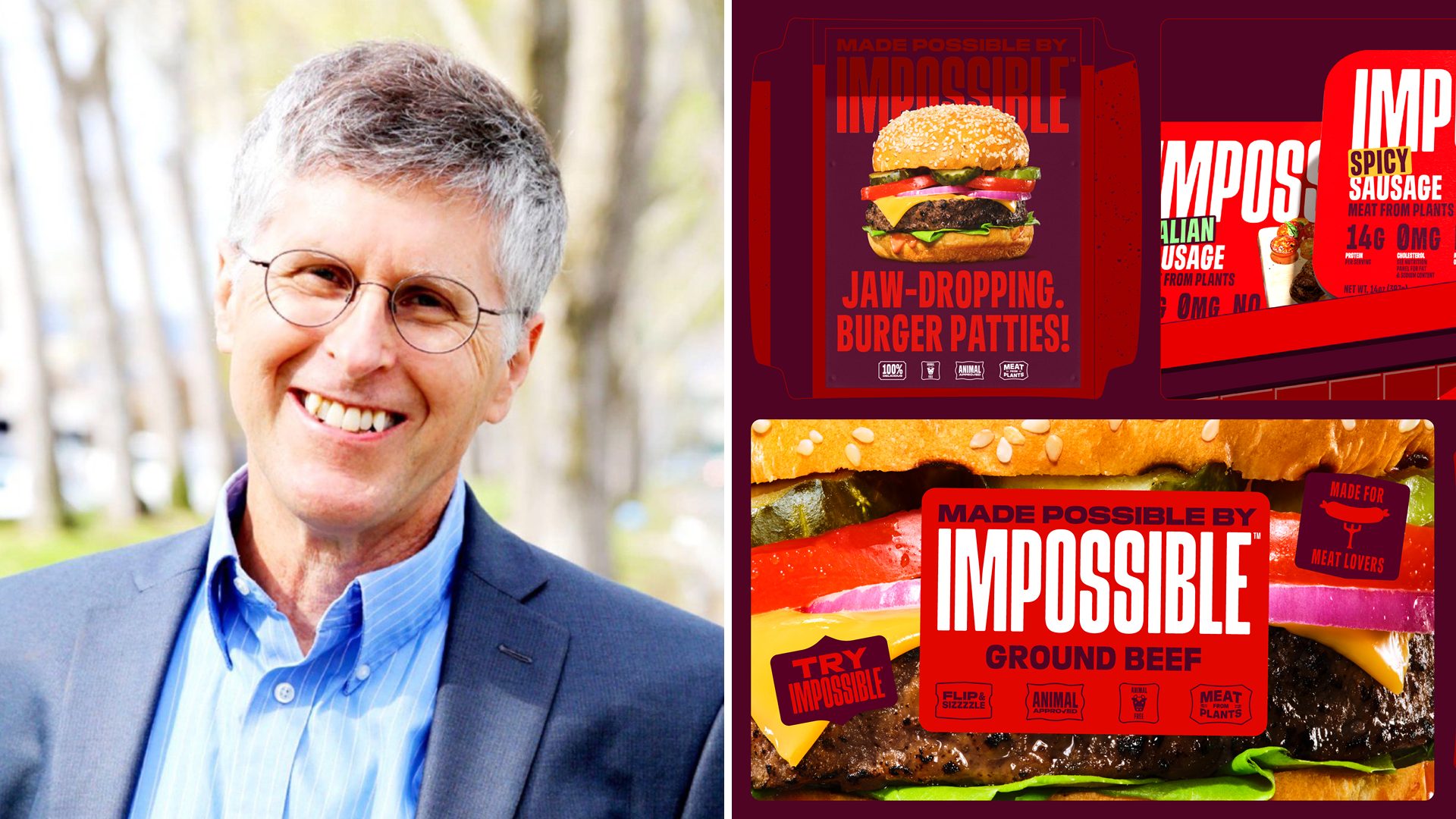

Beyond Meat reported failing to meet sales projections while Josh Kobza, CEO of Restaurant Brands International Inc., the parent of Burger King told Bloomberg sales of the Impossible Whopper had failed to meet expectations.

“The performance of the Impossible Burger at Burger King can be impacted by various factors, and one of the challenges it faces is the core customer base of Burger King,” Valentino Chiavarini, CEO of Green Hive, told FI. “Burger King traditionally caters to consumers who are primarily seeking meat-based options, potentially leading to lower acceptance among their existing customer base.

“On the other hand, strict vegans may be hesitant to endorse a supply chain that continues to offer meat-based options, especially when they perceive such practices as cruel.”

Another issue, said Jack Ellis, who leads agriculture and food research at the Cleantech group, is the product itself: If plant-based alternatives don’t meet the appearance, taste and smell expectations of meat-eaters, there’s little chance these products will win anyone over.

“As it turns out, some of the plant-based alternative protein products available to consumers today do not seem to be meeting these criteria. If these products are not satisfying omnivorous consumers’ expectation around taste, aroma, and so on, then, quite simply, they’re unlikely to reorder those products next time they visit the restaurant,” Ellis said.

Another issue is the price point.

“Plant-based prepared foods generally are a bit pricier than their meat counterparts,” noted Nadia Santana, a nurse practitioner at Avenue Family Health. “Eating plant-based is very economical if you are shopping in the grocery store, but with surcharges like paying more for oat milk substitute in your coffee or for a side of avocado, it may not be affordable to many.

“Until we make this type of diet more affordable to the masses, it may struggle to gain momentum.”

At chains like Clover Food Lab, which prides itself on serving a variety of vegetables, labor costs also are an issue. L. Burke Files, a senior analyst at Unicus Research, noted vegetarian dishes take more time to prepare, leading to fewer menu choices and more waste.

“Today, most restaurants offer vegetarian options. Vegetarianism is no longer a niche specialty,” Files said. “Thus, diners can choose a restaurant that offers more options than just vegetarian. A local steakhouse offered a vegetarian grilled cauliflower steak with onions, peppers and rice. So, my wife and I ordered some beef ribs with root vegetables and the cauliflower steak, and we shared the meals — it was wonderful.”

The Good Food Institute says some 60% of U.S. households purchased plant-based alternatives in 2022. Future Market Insights projects the market will grow from $11.3 billion in 2023 to $35.9 billion in the next decade.