Milk alternatives continue to hold the largest share of all plant-based categories—15% across the total market and 41% in the natural channel—as ongoing innovations intrigue a broader group of consumers.

Despite this growth, inflation remains a challenge for plant-based milk producers. Some varieties are also being discontinued or facing pushback from dissatisfied consumers.

2023 Category Performance Reflects Inflation, Repeat Purchases

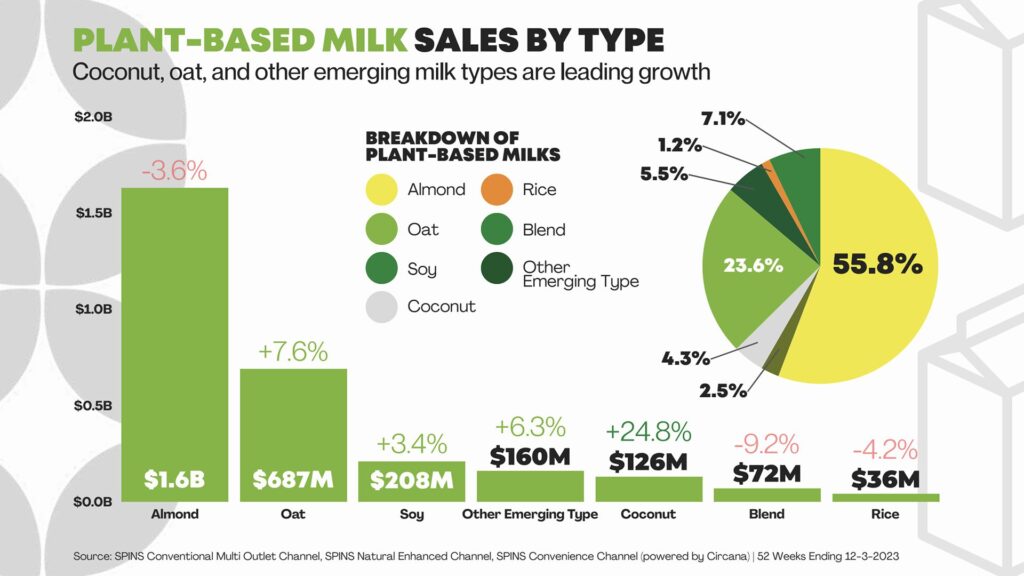

Per the Plant-Based Food Association’s (PBFA) 2023 State of the Marketplace report, U.S. retail dollar sales for plant-based milk reached $2.9 billion last year, while unit sales declined by 7.5%.

Graphic Source: PBFA 2023 Plant-Based Foods State of the Marketplace report

Furthermore, 44.1% of households purchased plant-based milk and 78.5% of households repeated their purchases, which suggests that most shoppers remain loyal to the category.

Innovation is a Key Category Driver

In terms of variety, almond milk continued to make up most sales of alternative milks in 2023, but oat, soy, and coconut saw the most dollar sales growth.

Other emerging milk types that grew in dollar sales included flax, cashew, and sunflower seed. Many such varieties were on display at the 2024 Specialty Coffee Expo.

“Plant-based consumers indicate that they have increased their plant-based dairy consumption due to more variety and novelty now available,” noted PBFA’s report authors. “As such, plant-based dairy products have the incredible opportunity to impact every eating occasion consumers experience, both inside and outside of the home.”

Plant-based milk producers continue to innovate and expand into new territory.

For instance, Israeli start-up Better Pulse recently unveiled a plant-based milk base made with black-eyed peas. When used as a milk alternative format, the company told Food Navigator that the base is creamy, sustainable, and delivers eight grams of protein per serving – at least three times more than most oat milk alternatives.

Oat, Cow’s Milk Mimics Grapple with Scrutiny

Per Innova Market Insights, consumers are still most open to trying plant-based milks made from familiar ingredients such as oat and coconut.

Some are turning their back on oat milk brands like Oatly and Planet Oat, however, as scrutiny grows over their nutritional value, low protein content, unpopular additives, and relatively high glycemic index, reported Yahoo Finance.

Alt-dairy beverages that are created to mimic the taste of cow’s milk are also struggling to capture market share.

In March 2024, Danone discontinued Silk Next Milk and So Delicious Wondermilk. The CPG giant debuted both offerings in late 2021 after replicating the traits in milk — its taste, nutritional components, molecular composition— but in plant form, reported Food Dive.

NotMilk, the mimic produced by unicorn Chilean food-tech company NotCo, is also dealing with the curdle of consumer malcontent. Per Yahoo Finance, some consumers say the product fails to recreate the taste of cow’s milk and they can detect certain unwanted flavors including pineapple and cabbage juices.

Plant Milk Makers Challenge CPG Sales

More consumers are also opting to make plant-based milks at home as inflation suppresses CPG sales on the unit and volume level.

Nut milk makers from brands like Nutr produce plant milks by thoroughly grinding whole ingredients and mixing them with water.

Online searches for “Nutr milk maker” have increased by 1,500% over the past 24 months, according to Exploding Topics.

Nut milk makers are part of the Plant Milk Maker meta trend.

In addition to handling a variety of ingredients like nuts, grains, and legumes, plant milk makers can produce different textures, from thick and creamy for nut milk to light and watery for grain milk.

The Food Institute Podcast’s “Foodservice Gamechangers” Series

Get to know the men and women behind the scenes of foodservice distribution in a new, limited series from The Food Institute Podcast called “Foodservice Gamechangers.” Recently, Pat Mulhern, advisor to The Food Institute, sat down for brief conversations with seven of the most influential foodservice merchandising and distribution leaders. Highlighting their food career journeys and management styles, the conversations feature insightful thoughts on what may lie ahead for manufacturers, distributors, and operators in foodservice.