In June 2023, the USDA issued final approvals for two cell-cultured meat companies to sell their products to the public, making the U.S. the second country after Singapore to make such an allowance. As Reuters reported, both companies — Upside Foods, Inc. and Good Meat, a division of Eat Just, Inc. — claim they’ve already begun production for sale.

This watershed moment arrived amidst a widening shakeout in the world’s alt-meat sector. As money flows less freely due to surging interest rates, investors have sharply pulled back alt-meat funding, just as inflation increases production costs and makes consumers more selective about their food choices, reported Bloomberg.

The Food Institute checked in with Jennifer Bartashus, senior analyst at Bloomberg Intelligence, to discuss what this approval signals for the plant-based meat category.

This Q&A has been edited for length and clarity.

To what extent will cell-cultured meat sales impact the overall outlook for plant-based meat alternatives in the near future?

We remain optimistic about the potential for the plant-based industry. The outlook probably doesn’t change with the approval of cultivated meat, [as it] is still several years away from reaching the scale to compete with conventional proteins and plant-based alternatives.

The first products will be at higher-end restaurants and out of reach for most consumers, so plant-based has an advantage in terms of accessibility. It is unclear how quickly consumers will embrace cultured meat, and if plant-based products continue to improve, some shoppers may prefer brands and products that are more familiar.

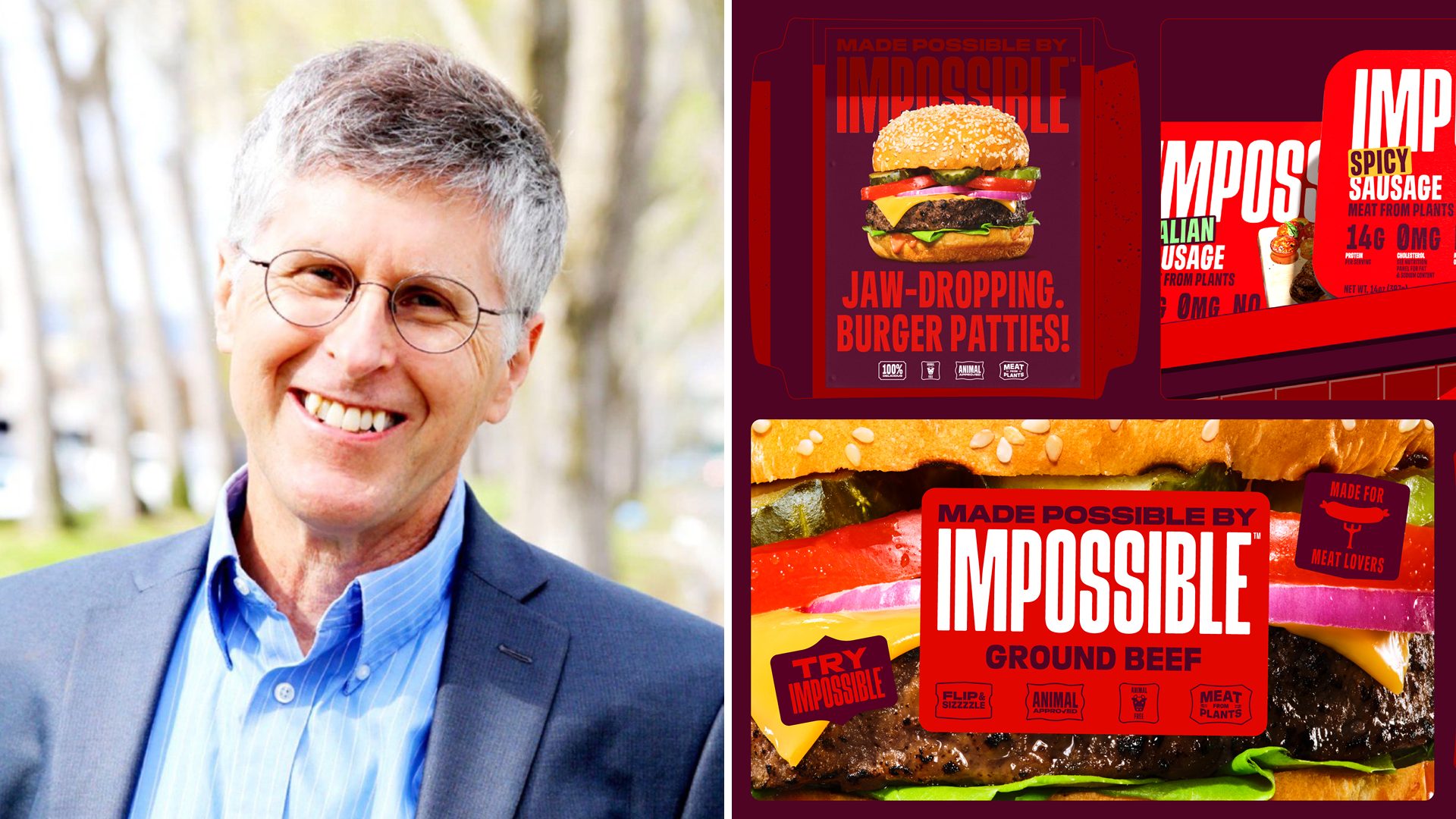

What does this approval signal for major faux meat producers like Beyond Meat and Impossible Foods? Could cell-cultured offerings capture a significant portion of their flexitarian consumer base?

For now, we don’t think the approvals for cultivated meat signals any major changes for plant-based leaders like Beyond Meat or Impossible. Over time, cultivated meat may compete for the flexitarian customer, but right now one of the biggest reasons flexitarians buy plant-based products is for health reasons and to reduce meat consumption. So for those consumers, they may not immediately perceive health benefits of cultivated meat (although there are some).

And we are several years away from cultivated meat reaching the same distribution of plant-based alternatives. As it becomes more widely commercially available that may change, but … a lot of consumer education will need to happen to drive acceptance.

What about “hybrid” products? Do you foresee this approval boosting the overall production of meat alternatives that blend plant-based and cultivated meat ingredients?

We may see more partnerships that create hybrid products. One example would be the integration of cultivated fats into plant-based products. Fats have a big impact on taste, texture, and smell of products, so the ability to use animal fats that are cultivated could help drive new product innovation that can inspire a new round of trial by shoppers.

Other hybrid products that combine cultivated and plant-based (or even combine cultivated with conventional proteins) can create a new step change in innovation where we get closer to the taste consumers expect but still deliver on the environmental and animal welfare promises.

Editor’s Note: This is part two of a series exploring cultivated meat developments. Part one features an FI Exclusive interview with UPSIDE Foods CEO, Amy Chen.