Here are trending economic and food industry data points, as well as major economic and company earnings releases for the coming week: unemployment benefits, global debt, surging commodities, restaurant reservations, Coca-Cola (COKE), and more

Trending Economic News

More than 300,000 jobless people are getting cut off from extended unemployment benefits prematurely because of an outdated method used to determine who qualifies for aid. Benefits are automatically extended when jobless rates hit certain thresholds, but some states aren’t taking into consideration new programs created during the pandemic. Alabama, Maryland, and Minnesota are among states that have been most affected.

Central banks around the world continued to pour money into their economies despite a sharp rebound in global economic growth. ECB kept interest-rate at -0.5%, Japan at -0.1%, and U.S. at 0.25%. Brazil and Russia are among the very few countries that plan to cut back on borrowing. Total global debt reached an all-time high of $281 trillion at the end of 2020, and 2021 is expected to set new records.

Corn, soybeans, and wheat surged on Chinese demand. A drought in Brazil, a cold snap in the U.S., and dry soil in western Europe all led to higher commodities futures. Combined with worries about global food inflation and strong Chinese consumer demand, commodities prices are seen rising to new records.

Upcoming Economic Release

| Forecast | Previous | |||

| 4/29/2021 | GDP (Q1 est annualized) | 5.0% | 4.3% | |

| 4/30/2021 | Personal income (Mar) | 20.0% | -7.1% | |

| 4/30/2021 | Consumer spending (Mar) | 3.8% | -1.0% | |

| 4/30/2021 | Consumer sentiment index (Apr) | 86.5 | 84.9 |

Source: Bloomberg, CNBC, Trading Economics, The Conference Board, Food Institute

>> For more information on CPI/PPI and Retail Sales, go to Food Institute Economic Benchmarking.

Select Food & Beverage Industry Data Points

Restaurant Industry

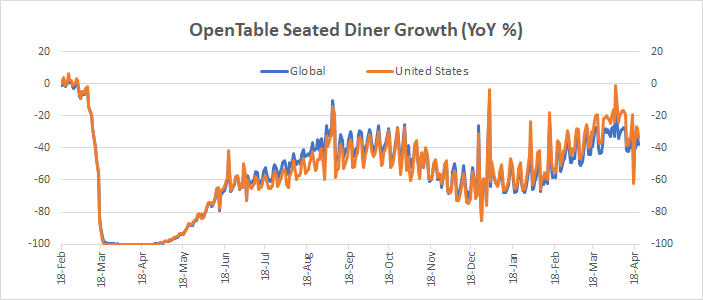

- OpenTable restaurant diner growth data (2019 baseline): U.S. = -33.66% as of Apr 21, 2021

Beverage Industry

Coca-Cola reported Q1 2021 results on 4/19

- Net Revenue: $9.0 billion (+5% vs. last year)

- Operating Income: $2.72 billion (+9% vs. last year)

- Operating Margin: 30.2% vs. 27.7% last year

- Net Income: $2.25 billion (-19% vs. last year)

Key Takeaways:

- Unit case volume remained flat, with strength in at-home channels being offset by coronavirus-related pressure in away-from-home channels

- Business Segment Performance:

- Sparkling soft drinks grew 4%

- Nutrition, juice, dairy and plant-based beverages grew 3%

- Hydration, sports, coffee, and tea declined 11%

- New products launched focus around leveraging existing brands such as smartwater® and adding functional variants

- Hard seltzer is also a potential growth area with the Topo Chico™ Hard Seltzer brand

- Near to medium term growth is contingent upon the reopening of the foodservice sector

Earnings Calendar of Select Companies

| Announce Date | Company | EPS Estimate | Previous Quarter EPS | |

| 4/26/2021 | J & J Snack Foods Corp (JJSF) | $ 0.12 | $ 0.09 | |

| 4/27/2021 | Archer-Daniels-Midland Co (ADM) | $ 1.05 | $ 1.21 | |

| 4/27/2021 | Starbucks Corp (SBUX) | $ 0.53 | $ 0.61 | |

| 4/27/2021 | Mondelez International Inc (MDLZ) | $ 0.69 | $ 0.67 | |

| 4/28/2021 | Yum! Brands Inc (YUM) | $ 0.86 | $ 1.15 | |

| 4/28/2021 | Brinker International Inc (EAT) | $ 0.78 | $ 0.35 | |

| 4/28/2021 | Pilgrims Pride Corp (PPC) | $ 0.35 | $ 0.25 | |

| 4/28/2021 | Cheesecake Factory Inc (CAKE) | $ (0.08) | $ (0.32) | |

| 4/28/2021 | Wingstop Inc (WING) | $ 0.31 | $ 0.18 | |

| 4/29/2021 | Amazon.com Inc (AMZN) | $ 9.48 | $ 14.09 | |

| 4/29/2021 | Restaurant Brands International Inc (QSR) | $ 0.50 | $ 0.53 | |

| 4/29/2021 | Molson Coors Beverage Co (TAP) | $ (0.04) | $ 0.40 | |

| 4/29/2021 | Hershey Co (HSY) | $ 1.80 | $ 1.49 | |

| 4/29/2021 | Mcdonald’s Corp (MCD) | $ 1.81 | $ 1.70 | |

| 4/29/2021 | Kraft Heinz Co (KHC) | $ 0.59 | $ 0.80 | |

| 4/29/2021 | Keurig Dr Pepper Inc (KDP) | $ 0.31 | $ 0.39 | |

| 4/29/2021 | Domino’s Pizza Inc (DPZ) | $ 2.93 | $ 3.46 | |

| 4/29/2021 | Texas Roadhouse Inc (TXRH) | $ 0.57 | $ 0.28 |

Source: Bloomberg, CNBC, Yahoo Finance, Food Institute