The Problem

Top two investor questions for a consumer startup? 1) Do you have product-market fit yet? And 2) What is the platform?

Building a platform brand right from the start is the strategy equivalent of branding agencies telling you to build a lifestyle brand. The words “lifestyle” and “platform” appeal to our desire for scale, but that’s about all they do.

There is no scientific evidence that either approach leads reliably to scale, yet brands continue to launch this way, usually the ones with a lot of seed money. If your name is Dwayne Johnson or Jessica Alba, you might be able to pull it off. I notice that The Rock is NOT platforming either of his CPG brands (Teremana and Zoa). I think I know why.

Founders usually anchor their platform brands in an ingredient (e.g., chia) or attribute (e.g., keto). The idea is that consumers will buy from multiple categories if your brand can ‘own’ the platform in their minds. Sounds sexy. But there’s a problem. In Ramping Your Brand, I published the first-ever data science showing that multi-category, ‘platform’ consumer startups tend to decelerate well before they hit $100M in sales. This may not prevent an exit for a few, but it almost always does. And behavior experts know why.

It’s not that platform brands ‘fail’ in absolute terms, fail to grow or that they fail to survive in the market. With enough slotting money, I’m still shocked at how much scale you can buy in a fee-hungry FMCG retail environment.

It’s that brands that platform too early rarely scale. They don’t scale because they violate the Power of Focus principle and fail to generate initial memorability with a critical mass of enthusiastic fans. In many cases, I have found that the R&D put behind each set of category UPCs isn’t yielding the same level of quality for consumers. Shortcuts get taken. Mediocrity has a way of creeping in when you try to do too much too quickly to chase the scale that investors demand on an unrealistic timeline.

But there’s a more fundamental problem with brands that platform immediately. They rely on a fallacy. The fallacy is that shoppers shop primarily for ingredients or attributes and then consider categories. That would be nice. But it just isn’t how humans think. We procure culturally salient categories of objects. Categories are collective creations. We always have procured material culture this way. And we select producers based on category-specific criteria.

So, just because I prefer almond flour in my crackers doesn’t mean I care about it in my baking mixes. However, if I build a killer almond cracker brand to scale, I will have an easier time using the brand’s credibility to cross-promote other categories. Even then, billion dollar brands rarely operate as platforms across multiple categories.

Consumers already have enough brands. If you’re launching a new one, you will be replacing one they use now on a similar occasion. The optimal way to win this tough battle is to come off as a category expert, as a highly focused innovator in a specific category. Or better yet, to create a new category in consumer culture and be known for it.

De-Platforming Your Brand

I often get asked, “What should we do if we platformed out of the gate and want to change that?”

What follows is my response using a composite case based on real-world client scenarios from my work in the industry. It represents a good case scenario where founders stumbled onto some lucky UPCs. It is presented for illustrative purposes only to inspire those on the fence. It shows you how to think about re-focusing a platform brand into something that can accelerate adequately off of consumer enthusiasm—and setting an appropriate time frame for doing so.

RAMPCO’S ORIGIN

RampCo is an angel-funded early-stage food company selling nationally in the natural/specialty channel and one division of a local Kroger banner near the company’s headquarters. The brand was seeded well enough to get into Phase 2 (>$500,000K in trailing annual sales) reasonably quickly by the beginning of Year 1 of operations. It did so by launching 8 UPCs in four different categories relatively quickly with brokerage assistance. One of the founders had old ties to a brokerage before forming the company.

The founders initially believed they had a multi-category ingredient platform whose key ingredient was primed for rapid acceleration. What follows is a dramatic re-focusing pivot. The focus is on the topline math only to demonstrate the feasibility of this rare strategic move.

THE RAMPCO PIVOT

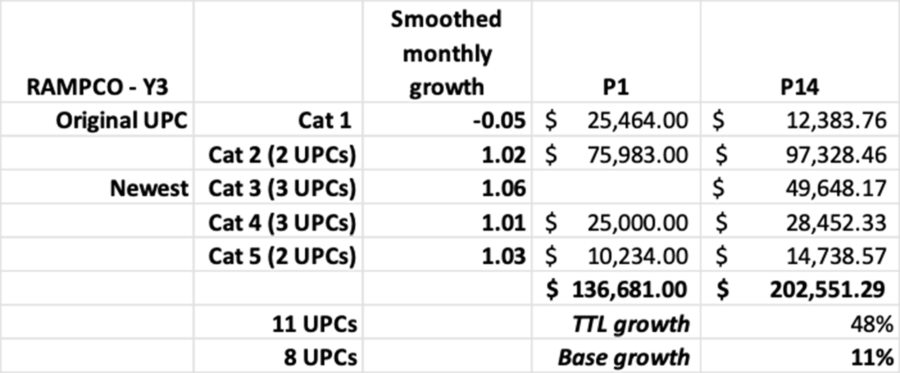

I’ll be using a P1-P13 periodization with P1 representing the month of May (before retail category review meetings generally start) and the beginning of the third full year of RampCo’s operations.

At P1, the brand has eight UPCs selling $136,681. This is our quad-week baseline. Since velocities have been stable or growing in all but one of the original four category sets, the founders decided it was time to launch UPCs in a fifth category to boost the top line. Launching to grow has been a key operating principle.

By P14, RampCo has grown quad week sales by 48% on a YoY basis (13 quad weeks) to $202,551. This was the fastest growth yet for the business. When the founders investigated the data more closely, they noticed that 75% of the third year’s growth had actually come from the new category UPCs’ first six months of sales. The base business had only grown about 11% (See Figure 1).

Figure 1. A Surprise Discovery

Since the founders didn’t expect the new category’s UPCs to do this well this quickly, it was a pleasant surprise for only six months of sales. They had a vigorous debate about continuing to platform the brand (they had another three categories of UPCs in development). The founders debated for a few days but quickly realized that the stability of the business merited taking a calculated risk on the new category as they knew it had the potential to become the core of the entire brand. They also had enough mixed consumer feedback to realize the other UPCs were no Skinnypop.

So, they decided to trim away the worst selling categories (Category 1 and Category 5) by letting the inventory sell out slowly and alerting distributors to delist them from their catalogues. This would simplify operations and allow their sales lead and brokers to focus on doubling the store count for the new category and adding modest amounts of stores to the remaining categories. Again, every category but the first had stable to growing sales and stable velocities at the U/S/W level.

They now put most of their emphasis on exploding Category 3 and invested in aggressive field marketing in their home market. If it didn’t work, they could fall back on their platforming strategy.

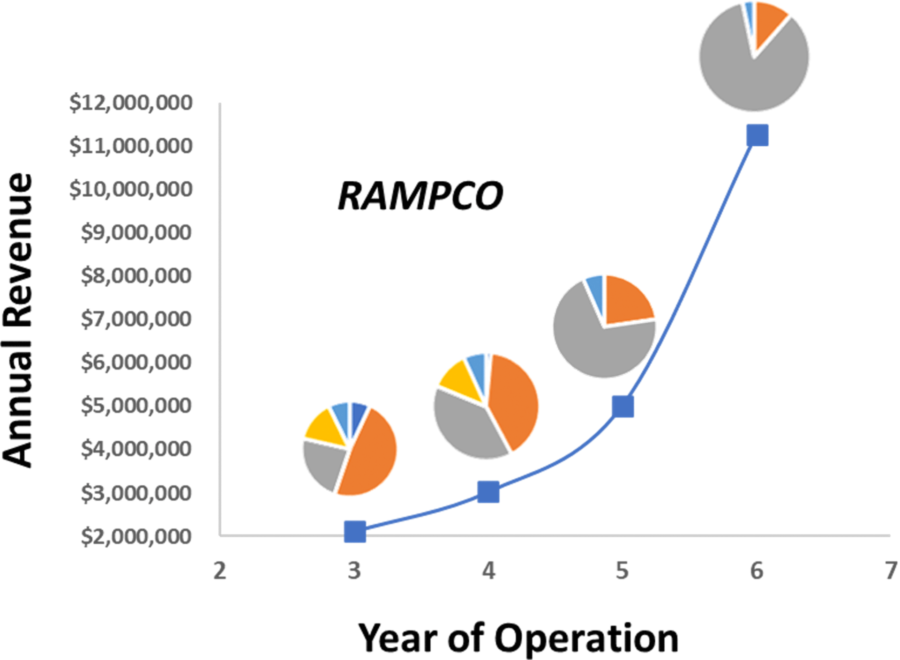

By P27, RampCo finds itself at another inflection point as the new category continues to ‘crush it’ at same stores. RampCo is now selling $276,534 on a quad-week basis and growing quad-week sales steadily every month, even after delisting three UPCs in two categories. The newest UPCs (in Category 3) had accelerated their monthly average growth rate to 8% due to adding stores in the back half of the year in addition to organic velocity increases. RampCo was now riding the Ramp of exponential growth.

From there, Figure 2 illustrates what unfolded as they hyper focused their efforts on one category and let the remaining two categories fade into a small % of the business. Even they were shocked at how simplified the business had become in just three years (see Figure 2).

Figure 2. RampCo’s Master Pivot

What may surprise some readers is how unwilling many platform brand operators are to invest in this three-year wait or to give this pivot approach a try. Given that even the best brands take 7-10 years to scale exponentially, this is an odd position to take. It also surprises me how many supposedly risk-prone venture capital investors don’t trust in the behavioral and cultural dynamics that support de-platforming.

Focusing on one category and expanding UPCs within it (e.g. Spindrift) allows operations and the supply chain to stop overwhelming the leadership’s time and headspace. With mental time freed up, leadership can finally focus on the critical out-of-store cultural insertions I discuss at length in my book (and which still work in our Covid-19 world). They can also focus on leading a well rounded 4P playbook and the kind of team necessary to support such a playbook.

Tight UPC focus within a single operating category is liberating at all levels of an early-stage company. Its opposite: UPC proliferation clogs everything up and leads mostly to stagnation and sector-level growth rates. This is true despite anecdotal cases you might find to the contrary.

About the Author

Dr. Richardson is the founder of Premium Growth Solutions, a strategic planning consultancy for early-stage consumer packaged goods brands. As a professionally trained cultural anthropologist turned business strategist, he has helped nearly 100 CPG brands with their strategic planning, including brands owned by Coca-Cola Venturing and Emerging Brands, The Hershey Company, General Mills, and Frito-Lay, as well as other emerging brands such as Once Upon a Farm, Dr. Squatch Soap, Proven skincare, Rebel creamery, and June Shine kombucha.

James is the author of “Ramping Your Brand: How to Ride the Killer CPG Growth Curve,” a #1 Best-seller in Business Consulting on Amazon.