Clean-label initiatives are rising in 2024 as concerns surrounding ultra-processed foods (UPFs) intensify and more consumers prioritize what’s NOT in their products.

According to a recent Clean Label Insights Study by Acosta Group, 81% of shoppers say purchasing clean-label food products is important to them. Over the past six months, most consumers knowledgeable about clean label purchased some of these products, led by plant-based milk, plant-based meat, and baby food sales.

“It’s clear that shoppers consider the absence of negatives, or an emphasis on what’s not in the products, to be the most important attribute in their clean-label purchasing choices,” said Kathy Risch, SVP, Thought Leadership and Shopper Insights, Acosta Group, in the report.

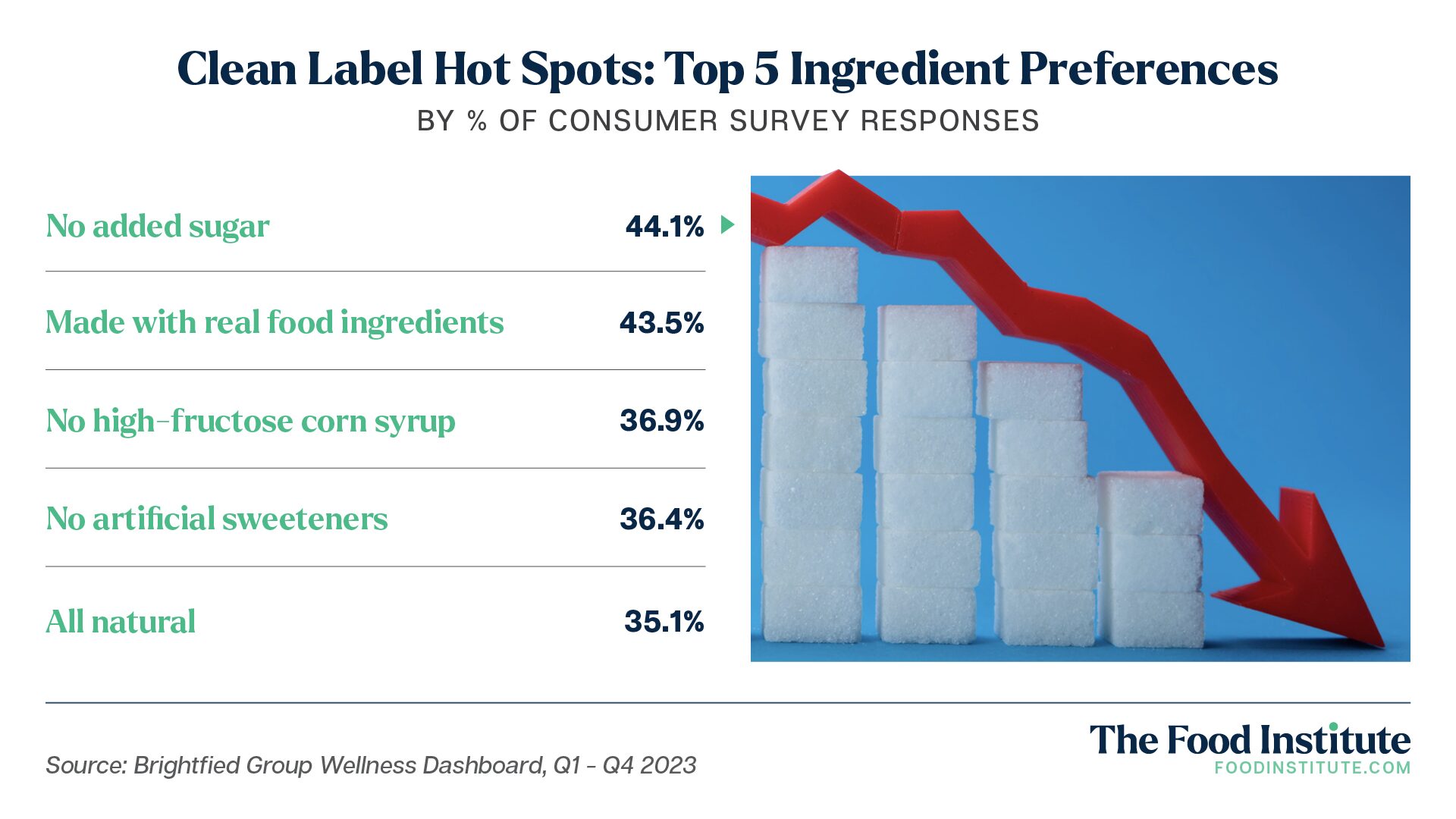

Data from Brightfield Group supports this movement.

In 2023, baby boomers led the demand for “no added sugar,” while Gen X and millennials over-indexed for “no high-fructose corn syrup” and “all natural,” respectively.

UPFs Amplify Ingredient Concerns

The importance of a clean label has been further inflated by negative press surrounding ultra-processed food consumption. As The Wall Street Journal reported, scientists are now highlighting the addictive nature of UPFs, with some proposing a new mental-health condition called “ultra-processed food use disorder.”

Sarah Keathley, a Registered Dietitian Nutritionist at Top Nutrition Coaching, defines UPFs as foods that are hyper-palatable and highly-processed with additives like sugar, salt, fat, stabilizers, artificial flavors, and artificial colors or preservatives.

In short, everything consumers don’t want to see on their ingredient lists.

“As we live in a society with a large availability of ultra-processed foods, our concern for its impact on our health grows,” Keathly told The Food Institute.

“Many have deemed these products unacceptable. In order to stay relevant, food producers must realize this need and start making changes to fit the population demand.”

Keathley notes that the majority of all food is processed in some way, however, per USDA standards.

“Even though the word ‘processed’ has negative connotations, it does not necessarily mean that some, or all, of the ingredients in that product are not healthy,” she added.

A Closer Look at Labeling Claims

To the same point, labeling claims that consumers seek most are not always accurate and reliable. Guidelines for who can make advertisements like “made with real ingredients” and “all natural” are loose, as the FDA does not have rigorous regulations for companies, Keathley said.

For example, a product labeled “all natural” per FDA regulations means that nothing artificial or synthetic has been put into a food that wouldn’t be expected to be there.

“However, this particular regulation and claim is not meant to address food production, processing, or manufacturing methods,” said Keathley. “It is also not indicative of a food’s nutritional or health benefit, which can be misleading to the consumer.”

As the Acosta study observes, legislation is accelerating the clean-label trend but 55% of all food and beverage shoppers believe more regulations are needed. That number increases to 72% for Gen Z and 62% for clean-label buyers.

While current claims do serve an indicator for products that are more minimally processed, at the end of the day, “it will be left to the consumers to determine the degree of food processing and what they are comfortable with putting in their own bodies,” said Keathley.

A Balancing Act for Food Tech

With misinformation playing out on both sides of the labeling equation, companies that prioritize nutritional value and transparency across the supply chain could hold the winning hand in the long term.

This includes producers in segments like plant-based that utilize food technology to produce or fortify their ingredients.

The need to reach beyond the minimum regulations required by the FDA could make labels like Clean Label Project Certified more of a key component in the future for food products.

“We live in a society where food technology can be a vital tool to help increase food accessibility, create sustainability, and assure quality, but it must be done safely,” said Keathley, adding that protocols for inspection and screenings must be put in place and openly allowed by the manufacturers.

Overall, Keathley believes that CPG producers must prioritize transparency and honesty to encourage consumer adoption and loyalty.

“Consumers are looking for real food with simplified ingredients. Keep that in mind from the beginning of conception to the end of packaging, where your product is on the shelf ready for purchase,” she concluded. “Offer up information on your product willingly and answer tough questions from consumers when asked in order to establish trust.”