“Food wars” are simmering, as geopolitical tensions have inspired a rise of protectionism amid concerns about dwindling supplies, according to one of the largest global agricultural commodity traders, Olam Agri. The Singapore-based agri-business is part of the Olam Group, which supplies food worldwide.

“We have fought many wars over oil; We will fight bigger wars over food and water,” Olam Agri CEO Sunny Verghese said, according to Financial Times.

“Inflated costs of transport and consequential production disruptions (due to shipping delays and supply shortages) prompted by the Red Sea shipping crisis (or the) Middle East crisis will continue to pose challenges for the industry this year,” Jena Santoro, senior manager of intelligence solutions at Everstream Analytics, told The Food Institute.

Food prices began to climb in the wake of the COVID-19 pandemic and surged amid the outset of the Ukraine conflict. Subsequent restrictions against Russia have resulted in some exports of grain and fertilizers being blocked.

Verghese said elevated food price inflation has occurred in part because of government intervention as wealthy countries stockpiled surpluses of commodities which has created “an exaggerated demand-supply imbalance.”

“India, China, everybody has got buffer stocks,” the CEO said. “That is only exacerbating the global problem.”

Climate change, which has hurt ag production in much of the world, has also led to a rise in protectionism worldwide, Verghese argued. He mentioned, for instance, India imposing export restrictions on various types of rice last year in an effort to curb rising domestic prices.

“You’re going to see more and more of that,” the CEO said.

At the recent Redburn Atlantic and Rothschild conference, Verghese also urged the gathering of industry executives, including leaders of Coca-Cola and Associated British Foods, to “wake up” and take more action on climate change. Governments should charge a tax for carbon, he contended.

“Carbon is free today, so we are polluting indiscriminately,” Verghese said.

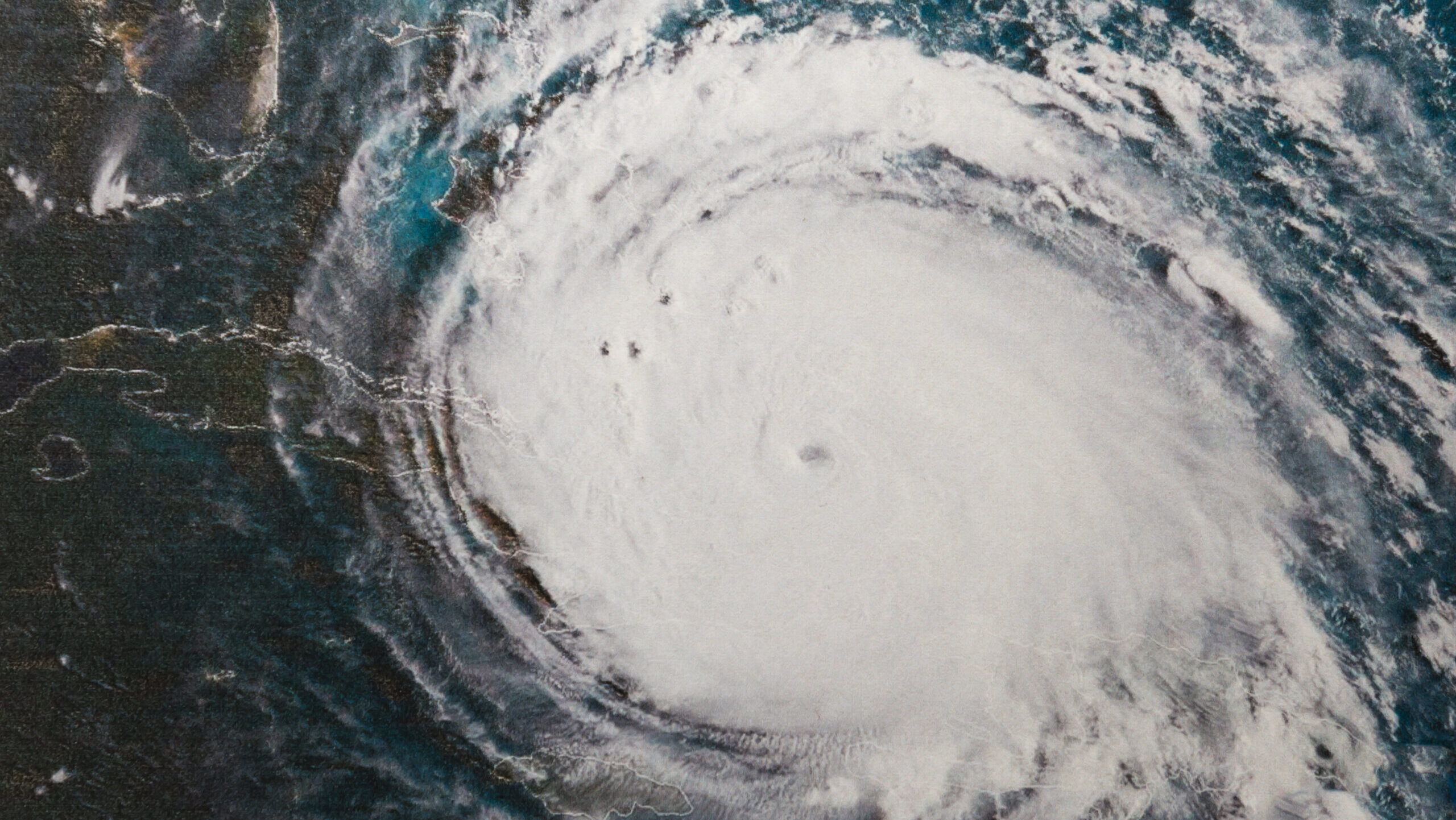

The biggest global supply chain issue for the second half of 2024 will likely be related to extreme weather, according to Santoro.

“The Atlantic hurricane season is off to a destructive start with Hurricane Beryl, and weather forecasters predict an … active season with numerous severe events expected to impact the southeastern U.S., the Gulf of Mexico, the Caribbean, and South America,” she said. “Supply disruptions to citrus, produce, coffee, and sugar are possible.”

The Food Institute Podcast

Tom Hamill, a food and beverage senior analyst for RSM US LLP, joined The Food Institute Podcast to recap the 2024 Summer Fancy Food Show. Hamill shares his thoughts on burgeoning trends from the show and how emerging specialty food brands can best navigate economic factors in the years to come.