Grocers and their CPG partners are feeling the impact of an uncertain economy, but by working together each part of the industry can help enable success for the other.

Grocers and other retailers have access to data that can be invaluable for the brands that fill their shelves, and gathering and sharing the right insights can drive sales and build valuable relationships with both customers and suppliers.

“Succeeding in retail has always required a solid data foundation, and over the past few years, the rise in supply chain challenges, omnichannel proliferation and the increased interest in private label have raised the stakes for grocers and CPG to leverage data to compete effectively,” said Manish Choudhary, CEO of SymphonyAI Retail CPG.

“As we move into 2023, retailers and CPGs are recognizing the value of data and are feeding AI models to expand the boundaries of their predictive capabilities and real-time decision-making to respond to opportunities and challenges,” Choudhary added.

KEY SHOPPER-RELATED INSIGHTS

Choudhary noted that, while there are a wide variety of shopper-related insights available to retailers, a few in particular stand out for CPGs as particularly valuable for their decision-making processes. Three of the most important are:

- Space elasticity, or how the incremental addition of space affects demand for certain items

- Demand transference, which is the interaction and correlations between items and can help companies understand halo or cannibalization effects

- Customer decision trees, which can be leveraged within assortment planning to help analyze and optimize decisions from multiple perspectives.

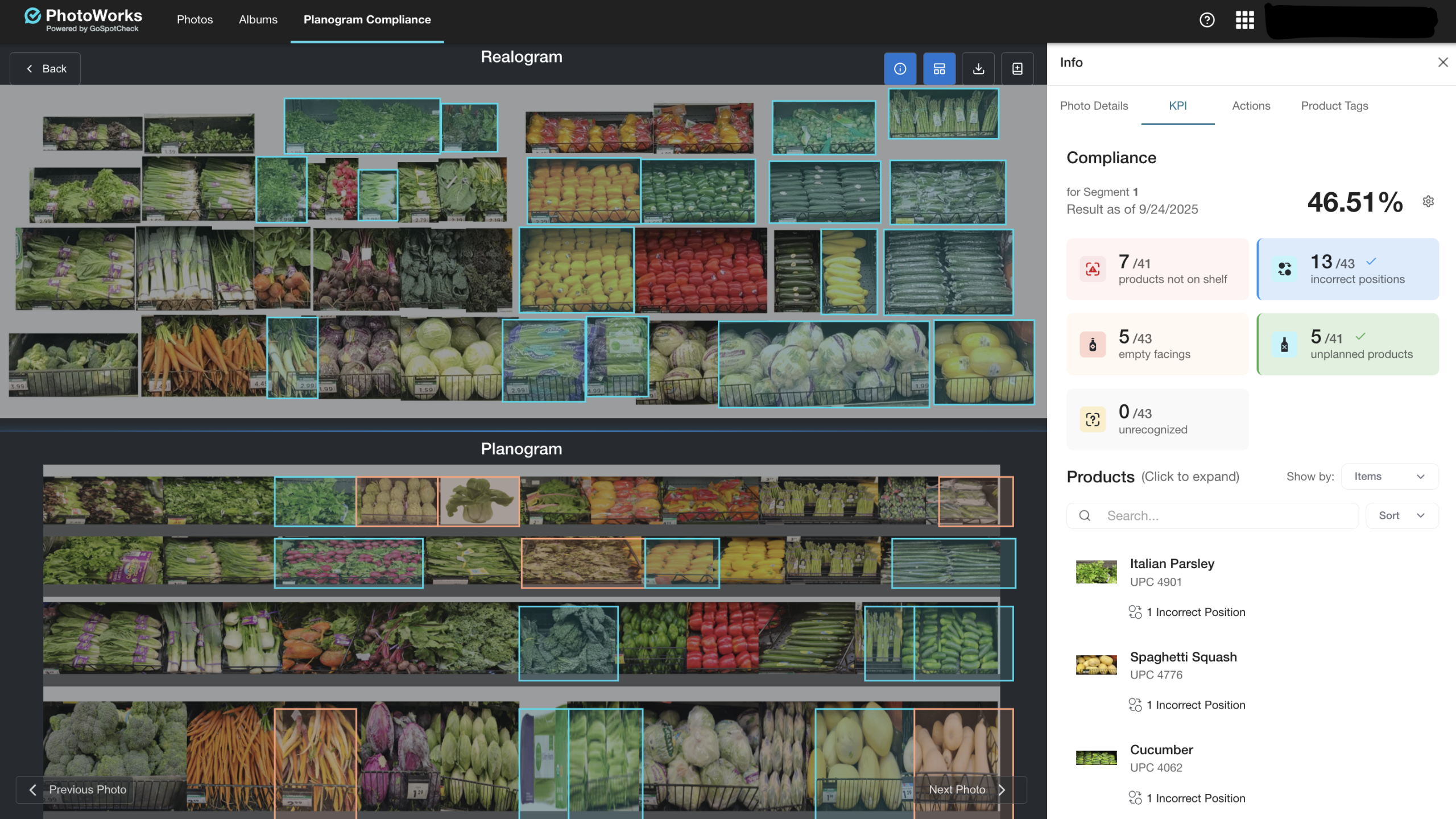

“CPGs can use insights to capture the reality of what’s happening across a grocer’s stores to understand factors like planogram compliance, product distribution, pricing and on-shelf availability, as well as rapidly addressing any stockouts on the shelf,” said Choudhary. “Ultimately, store intelligence can also influence the timing of category resets, because CPGs are able to make recommendations to retailers based on category needs, rather than rely on the traditional calendar-based approach.”

PREDICTIVE DATA IS KEY

The modern grocery space has too much data to be handled manually, let alone at speed required for modern retail. This makes AI key for gathering and analyzing intelligence to pull out valuable insights and enable agile execution at all levels, including store, SKU and shopper.

“Store and shelf intelligence allow retailers and CPGs to make shelf-planning decisions not only in real time, but to leverage data from various other areas of the store — ranging from planogram compliance to labor optimization – to optimize the ‘final mile’ at the shelf,” said Choudhary.

“A single version of the truth here is key. When it comes to inventory management, grocers and CPGs can use predictive data models leveraging robust data sets to strengthen their supply chains and anticipate and mitigate — rather than respond to — supply chain gaps.”

Democratization of data is key to ensuring true partnerships between retailers and CPGs. These insights should be shared across the organization and with key partners to enable all relevant parties to reach their full potential.

CPGs don’t have all the answers themselves, but grocers who share the right information can help them create the products their customers demand.