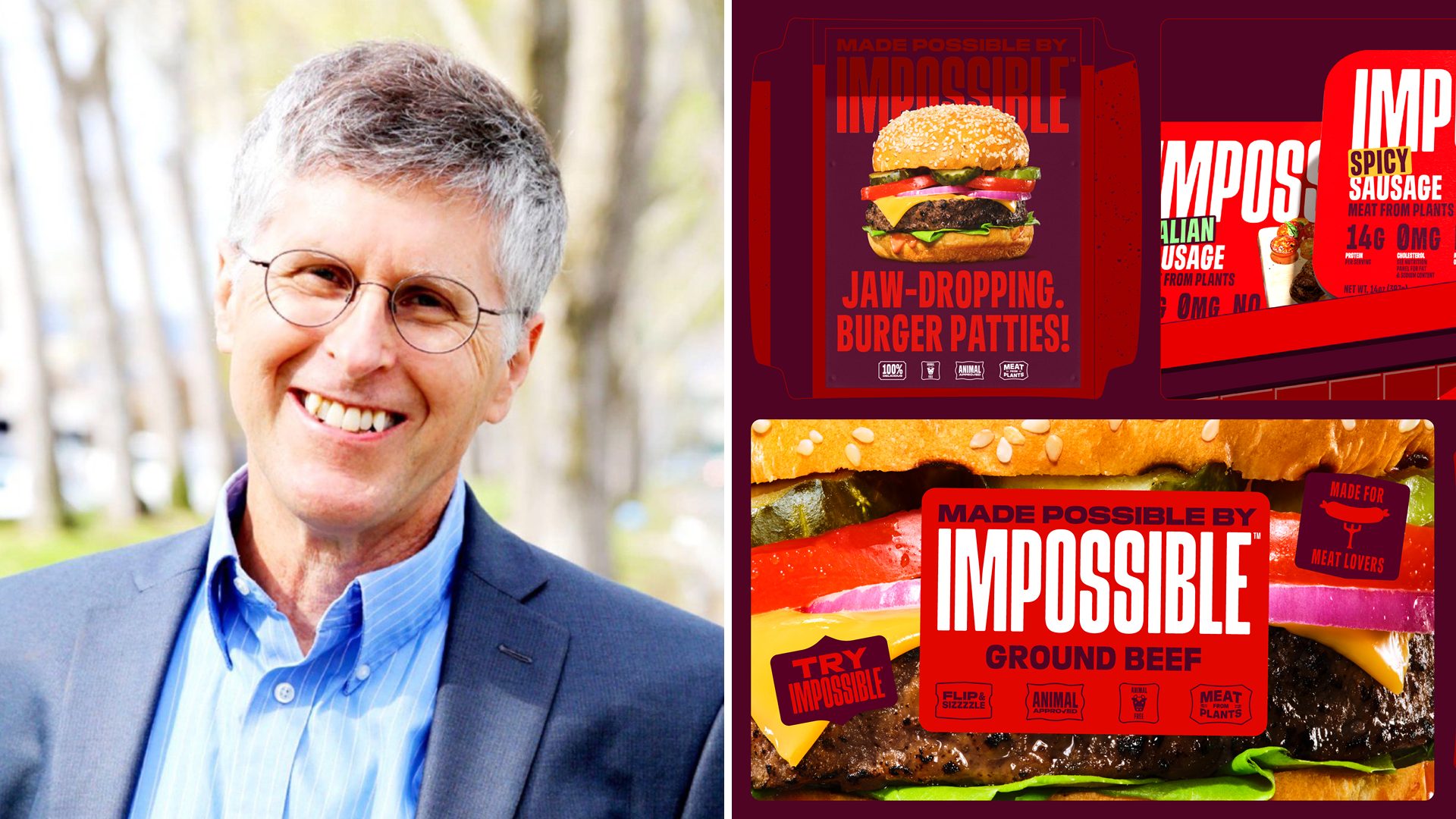

Earlier this month, a confluence of headlines from multiple sources reported a shift in sales and venture-backed capitalism indicating changing consumer mindsets regarding alt meat products and their plant-based pseudo-competitors – particularly seafood, fungi, and the versatile mushroom.

Food Business News reported two venture-backed alt-meat startups, Hooray Foods and Nowadays, are both ceasing operations amid declining demand for meat alternatives. Both San Francisco-based companies shared separate but telling social media posts detailing their plans to end production.

Plant-based meat sales hit their apex in 2020 when consumers enjoyed more discretionary income and focused on healthcare and well-being in the wake of the pandemic. Data from Mintel reveals that less than half of consumers who tried similar products at the time were repeat customers and cited qualities such as texture, quality, and flavor with much to be desired.

Meanwhile, sustainable seafood startups are garnering more attention from venture capitalists; according to Crunchbase, seafood-related startups have collectively raised nearly $3 billion to date. The key word here is sustainable – cell-based seafood doesn’t appear close to market readiness while some vegan alternatives may resemble whitefish or shrimp but often lack the nutritional punch of their natural cousins and often suffer from close, but not truly appetizing, fishy flavor.

Funding Reaches Fewer Candidates with More Potential

Still, many venture capitalists are looking to this sector to alleviate high beef prices and foster a retail and grocery culture of reliable, dependable, nutritious, and flavorful seafood alternatives even as the volume of seafood-based venture funding has diminished a bit—taking lessons from the alt-meat industry, funding is distributed among fewer entrepreneurs than in years past.

“The recent closure of two VC-backed alternative meat companies does raise questions about the long-term viability of the industry,” said Devon Ferguson, senior editor at Carnivore Style, to The Food Institute. “However, the simultaneous rise of sustainable seafood startups and the increasing interest in mushrooms and fungi as culinary ingredients suggest a broader shift in consumer preferences.

“The $3 billion investment in sustainable seafood startups is a clear indicator of the growing demand for more environmentally friendly food options. Consumers are becoming increasingly conscious of the impact of their food choices on the planet, and sustainable seafood aligns with this mindset. It reflects a genuine desire for healthier oceans and more responsible sourcing practices.”

As Go the Chefs Goes the World?

Meanwhile, smaller-scale applications of plant-based menus are thriving in foodservice kitchens. Mushrooms have long dominated meatless cooking as they add flavor and texture to meatless dishes, and Restaurant Business reported that other earth-grown products from the mighty world of mycelium are getting a chance to shine as fermented and steamed fungi are being incorporated into upscale dishes such as saffron risotto and even cheesecake. The natural umami flavor of many types of mushrooms makes them ripe for experimentation despite the challenge of enticing wary customers who may bristle at the very mention of “plant-based,” it’s far from the first time chefs around the country have used plant-based innovation in crafting their menus.

“Top chefs & foodservice brands have led successful, high-volume plant-based programs for decades,” said Minh Tsai, founder and CEO of Hodo, who told The Food Institute that he believes the “dust is settling” on the first phase of plant-based options for consumers in retail and restaurant. “Most of these plant based protein dishes are quiet, stealth successes, deep currents running constantly over the years, while the turmoil on the surface steals the spotlight,” he said.

“Thoughtful plant-based protein menus are meaningful to consumers and have staying power. With high-impact ingredient choices, these restaurants have created long-standing customer favorites,” he added, noting that chefs have a long history of featuring dishes that later set the standard of culinary trends in the greater industry.

Acosta Group recently published its Plant-Based Shopper Insights Study, which revealed that in the past year, plant-based product sales reached a record $8 billion and 88% of active users report a moderate-to-high commitment to the category despite ongoing food inflation. One-third of consumers hope to see more plant-based offerings at stores.

“Shoppers place equal importance on obtaining reliable and accurate information from brands, retailers and the media about plant-based foods so they can make well-informed choices,” said Kathy Risch, senior vice president, Consumer Insights & Trends at Acosta, “especially those beginning their plant-based journeys.”

The number-one reason shoppers turn away from plant-based products? Affordability. But as the technology continues to evolve and consumers more carefully target their preferred products, there’s only one direction the cost of those products can go—down, and off the burgeoning plant-based shelves of retail and into consumers’ carts, homes, and health.

Still, the success of this industry sits at the fulcrum between affordability and consumer demand. As Ferguson later noted, “The key is to strike a balance between sustainability and consumer satisfaction. While the alt-meat industry may see some pullback, the broader movement towards sustainable dining is here to stay, and it’s up to chefs, entrepreneurs, and investors to keep innovating and meeting the evolving demands of conscious consumers.”