Dry January is here, and with it millions of commitments to drink less, drink better, and/or stop drinking altogether. For many consumers, the turn of the new year is an opportunity to assess what they put into their bodies, why they do so, and how they might change to experience more fulfilling lives.

Thanks to ongoing innovation in the ready-to-drink (RTD) cocktails, mocktails, and functional ingredients space, the question to drink or not to drink has never been easier to answer for many people – dozens of brands are experimenting in the nonalcoholic (NA) and low-alcohol space, offering consumers the opportunity to not so much choose sides but merely choose wisely according to their preferences, dietary needs, and personal goals.

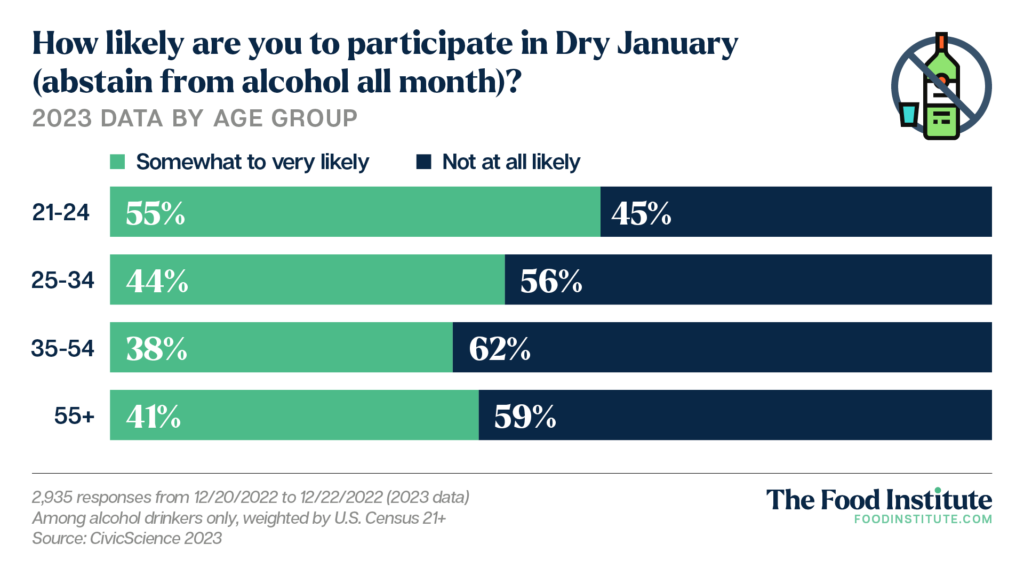

According to a recent study published by the CivicScience platform, Gen Z has a large contingent willing to try Dry January – 55% said they’re “somewhat likely” to take on the annual challenge. Meanwhile, those over 55 years old are becoming more interested as 41% agreed they are somewhat likely to take part – a 2% jump from the same demographic polled in 2022.

Supporting this data is a slew of research from NIQ; sales of NA beers, wine, and spirits spiked 31% over the past year in the $510 million market. Per the report, the top three category needs consumers respond to are:

Wellness

- Desire for transparency with inclusion of “free from” stated attributes

- Lower calorie alternatives

- Sustainability and corporate responsibility

Convenience

- Can or bottle options in the right pack size for the type of offering

- Ease of purchasing and availability in the channels for friction-free shopping experiences

Premiumization

- Drinking better, not more

- Authenticity in cocktail offerings

Though sales of NA products have grown steadily each year for the past five, the jump from 2022 to 2023 far eclipsed the others – $388.4 million revenue to $509.6 million (31.2%).

“The no- and low-ABV trend continues to rise and shows no signs of slowing down, making it a permanent fixture in the beverage landscape,” said Andrew Merinoff, CEO and founder of Dispact Ventures and CEO and co-founder of Chinola Liqueur, to The Food Institute.

“Also known as the mindful drinking movement, these lighter beverages are expected to remain on cocktail menus, as well as home bars. Consumers are seeking high-quality, low-ABV beverages.”

Corroborating the above data from NIQ, Merinoff said, “People are opting for premium choices because they want to know where the products they consume come from, who makes them, and they don’t want beverages filled with artificial flavors and preservatives.” He also added that the liqueur and cordials category is the third most-consumed spirit according to Drinks Business, with a global market size of $128.9 billion in 2022.

Better-for-You Can Be Tastier-For-You

Recent data from Mintel revealed that nearly 50% of sober-curious consumers say they’re doing it to improve their health. Mintel analysts also pointed out that success within this section of drinkers hinges upon a combination of “bold branding, better-for-you claims, and captivating flavors that rival traditional beverages.”

The better-for-you aspect of new drinks and flavors is difficult to ignore. From SKU to SKU, grocery to retail, brands are capitalizing on global flavors and health-halo superfoods, herbs, and supplements to drive sales and quench a market hungry for more. According to a recent report from Food Business News, drinks market analysis company IWSR “found the low- and no-alcohol products segment grew to more than $11 billion in value in 2022,” more than 30% growth in just four years. Meanwhile, a survey conducted by Edelman Data and Intelligence revealed 69% of alcohol drinkers, 81% of Gen Z consumers, and 78% of millennials would explore a “sober curious” or “damp” lifestyle.

Vikrant Lal is director of technical business development at foodbev consultant BevSource and who noted in the same article that mushrooms such as ashwagandha, cordyceps, and lion’s mane have been especially popular due to their adaptogenic, mood-boosting effects. He also noted ingredients like turmeric, which is associated with anti-inflammatory qualities, caffeine, l theanine, and ginger extract are also common potential additives.

In addition to using novel ingredients to craft highly functional and better-for-you cocktails and mocktails, many brands are moving into the business of drinks that actually taste like food.

“We’ve seen a ton of bartenders all over the country creating cocktails that riff on very traditional dishes,” said Leith Steel, senior strategist and head of insights at Carbonate, a hospitality marketing agency, to The Food Institute.

“From hamburgers in the case of MACHETE’s (Greenboro, NC) Bigfoot Sighting cocktail including Wagyu fat bourbon, ketchup, mustard, pickle and onion bitters, to a smoked salmon bagel in the case of The Anvil Pub & Grill’s (Birmingham, AL) Everything Everywhere cocktail, featuring smoked salmon-infused gin, vermouth, caper brine, and served in an everything-spice rimmed coupe glass garnished with capers, olive, pickled onion, and lemon twist.”

Steel also noted that they’re seeing more savory cocktails in general, such as MSG martinis – “The umami notes of MSG really makes the martini flavors pop,” he added.

As sweet vehicles for many flavors and ingredients, tropical cocktails may also return in 2024.

“[Tropical drinks] are taking the place of booze-forward drinks,” Merinoff added in his comments to The Food Institute.

“Tropical cocktails allow for a range of flavors that appeal to Gen Z,” he noted.

Themed bars and pop-ups are also beginning to appear, which is the type of experience consumers are seeking when they go out and which helps bring to life these drinks in a memorable way. According to CHILLED Magazine, passion fruit in drinks and food has grown 20 percent over the past four years on United States menus.”

There’s a word for themed bars and novel experiences to get consumers out of their homes and into the community – eatertainment, where the market is also rife with opportunity, as cataloged by Brittany Borer and The Food Institute in the video below.

The Omnichannel Still Rules Supreme

As to how consumers will find and purchase their beverages this January and beyond, look no further than the phones in their pockets.

“In 2024, consumers will see more alcohol promos on their retail apps,” said Emma Versaw, vice president of alcohol at Swiftly, to The Food Institute.

“While shoppers may skimp out on other grocery list items, the alcohol industry is recession-proof and retailers have taken notice. Following the launch of Swiftly’s Alcohol Cashback feature, our team found that those using the product visited stores 52% more than those who didn’t, proving that alcohol cashback offers and coupons really do drive foot traffic. Grocers seizing this opportunity will be a win-win – shoppers will get personalized offers for their favorite beer, wine, and spirits, and retailers will exponentially increase basket values at checkout.”