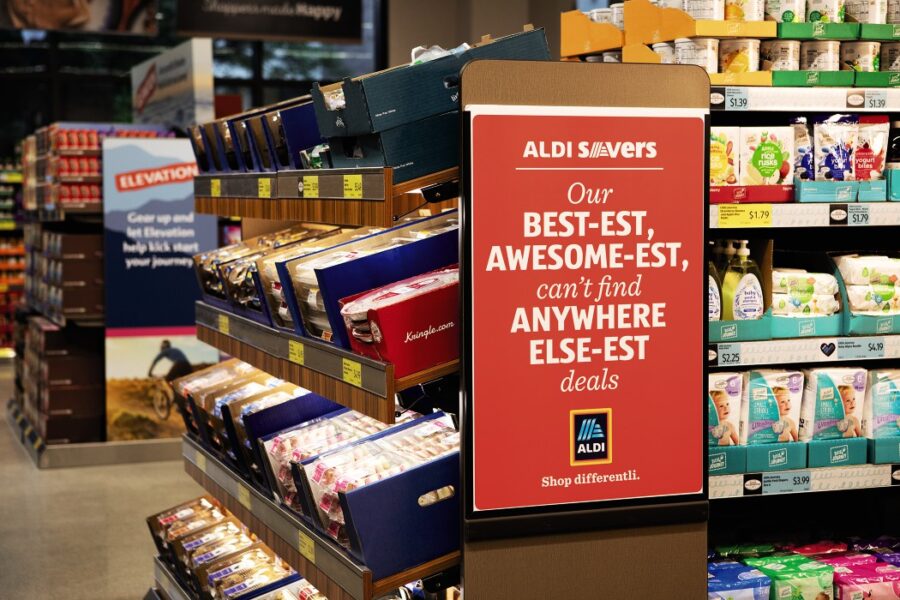

The current economic environment is very favorable for discounters like Aldi, Grocery Outlet and Lidl, and Coresight Research expects them to grow at twice the rate of grocery as a whole through 2026. While inflationary pressure may be subsiding, it still exists, and its impact will be felt in the long term.

“The discounters will be the trade-down beneficiaries of an inflationary environment and macroeconomic uncertainty,” said Sujeet Naik, grocery industry analyst at Coresight Research.

“Additionally, we expect the shift in consumer behavior toward greater frugality to be a structural trend that will outlast current economic disruptions. This will also benefit discounters,” Naik added.

LESSONS FROM DISCOUNT CHAINS

However, traditional grocers can take steps to help them retain market share against their off-price competitors.

Naik noted that discounters’ limited product ranges actually become an advantage when shoppers are working under a limited budget — they’re planning to buy fewer items and tend to follow a more organized shopping routine that shies away from impulse buys. In these cases a more compact selection can actually create a more satisfying shopping experience.

Naik laid out three strategies traditional grocers can learn from discounters and apply at their own operations. They are as follows:

1. Drive volumes through slimmed-down ranges.

“Discounters carefully select only the most popular flavors, package sizes and other variety types to generate high volumes per item,” said Naik. “This approach can give better bargaining power with suppliers given by larger volumes on more limited SKUs. Range reductions can allow them, on average, to more profitably channel higher volumes through each line.”

2. Strip out unnecessary expenses.

Grocers should strip out unnecessary expenses that can lead to a leaner cost structure — though Naik warned against cutting so much that it impacts the shopper experience.

3. Grow private label offerings.

Finally, retailers need to grow their private label offerings to help them offset the loss of margin due to price investment in other areas.

ACCENTUATE THE POSITIVES

Additionally, grocers shouldn’t be afraid to go on the offensive with their own differentiators. Discounters have limited e-commerce options and struggle with the added costs of picking and last mile, which will limit their ability to compete in this area even as they expand online, according to Naik. Their limited product range also works against them here by resulting in smaller average basket sizes, Naik noted, add:

“E-commerce remains an Achilles heel for discounters.”

“The struggle with e-commerce among discount retailers means it could become an important competitive weapon in the traditional retailers’ arsenal,” the grocery expert added. “Retailers should build out e-commerce options and create omnichannel experiences that smoothly blend in-store and online shopping.”

Mainstream grocers also can compete by adding value to their offerings by emphasizing their assortment, service, quality and convenience on top of affordability. They may not be able to beat discounters on price, but they can “compete with hard discounters on attributes that are more aligned with their core DNA,” according to Naik.