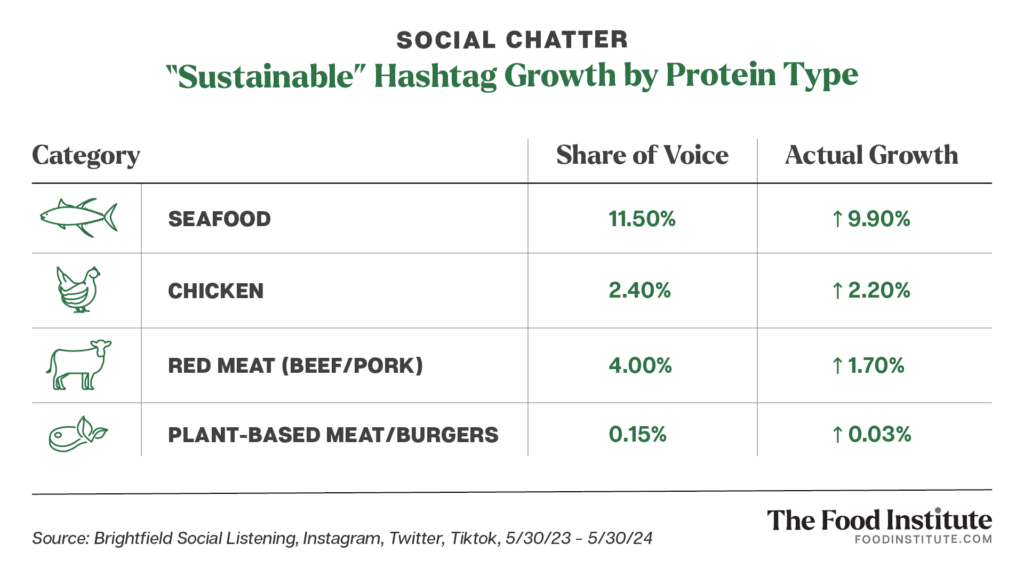

Growing interest in sustainably-raised meats, including grass-fed beef, is challenging meat alternatives, which continue to struggle with adoption and repeat purchases among their primary consumer base – flexitarians.

Sustainable meat production is rising across the food industry, as products with Regenerative Organic Certification experience significant growth.

Several major food companies have made regenerative commitments in 2024—including big meat players like JBS and Tyson—and some QSRs have also revamped their menus to include more “climate-friendly” animal products.

For instance, in May, salad chain Sweetgreen added “cuts of grass-fed, pasture-raised steak” to its roster of ingredients from partners with “principles and beliefs rooted in regenerative agriculture.”

“This trend underscores a consumer interest in what they perceive as environmentally friendly and ethically produced meat, broadening the sustainability conversation,” observed Bjorgvin Gudmundsson with Food ERP Inecta. “It challenges the plant-based sector to innovate further and possibly explore collaborations that emphasize comprehensive sustainability in food production.”

Jack Ellis, Senior Associate, Agriculture & Food at Cleantech Group agreed that ‘regenerative’ animal products might pose a competitive threat to plant-based alternatives.

“In general, plant-based products have not matched conventional animal-derived products in terms of taste, texture, and affordability, as they initially set out to do; while regeneratively-reared meats have the advantage of actually being conventional animal products, and therefore having all those sensory properties in the bag,” Ellis told FI.

Capturing Flexitarian Favor Through Sustainability

Although menu changes from the likes of Sweetgreen drew criticism from its most climate conscious customers, the QSR chain appears to be targeting a much broader swath of consumers—flexitarians.

Among U.S. households, 72 million identify as flexitarian and nearly half are buying plant-based foods, according to data from Numerator. Furthermore, 98% of consumers who buy plant-based protein alternatives also buy animal meat.

A growing number of consumers also claim that sustainability is very important when choosing which products to purchase.

In a 2023 Kroger shopper survey presented by the Plant-Based Food Association, 33% of respondents claimed they increased their consumption of plant-based foods because they believe these products are better for the environment.

Furthermore, 25% said they do not approve of the way animals are treated in factory farming.

Both Camps Have More Work to Do

In terms of demonstrating their actual positive impact in environmental terms, Ellis believes both regenerative/grass-fed meat and plant-based alternatives have work to do.

“While both may make strident claims about emissions reduction, biodiversity, and so on, these claims are not always robustly verified by third parties,” said Ellis. “As such, it is difficult for the average consumer to make a purchasing decision based purely on the supposed sustainability credentials of either category of product.”

As food industry advisor and author Dr. Bryan Quoc Le observes, there are criticisms regarding the way that grass-fed meat and dairy producers calculate the sustainability of their products.

“Some experts argue that grass-fed meat and dairy product are only marginally more sustainable than conventional animal products, and still lag behind significantly from the possible environmental gains achieved by switching to a plant-based diet,” Quoc Le told FI.

While some meat products that claim to be ‘grass-fed’ or ‘regenerative’ may prove to be far better for the environment, health, and the animals themselves than industrially farmed products, “the fact remains that they still come from animals and require significant inputs in terms of land, water, time, and so on,” Ellis observed.

On the other hand, while plant-based products cut the animal out of the equation, “they remain overwhelmingly reliant on a small number of mass-produced crops grown using significant amounts of agrochemicals and freshwater,” he added.

In both cases, deforestation may be a feature of the supply chain.

“The bottom line is that plant-based protein producers need to continue to improve the taste, texture, versatility, and affordability of their products, while also making an ever-more convincing case that their products can reduce our reliance on industrialized animal agriculture and its associated environmental, health, and ethical issues,” Ellis concluded. “On the latter point, regenerative meat producers need to do the same.”

The Food Institute Podcast

Tom Hamill, a food and beverage senior analyst for RSM US LLP, joined The Food Institute Podcast to recap the 2024 Summer Fancy Food Show. Hamill shares his thoughts on burgeoning trends from the show and how emerging specialty food brands can best navigate economic factors in the years to come.