Volumes of Hass avocados in the U.S. were up 16.5% year-to-date as of Feb. 19, according to the Hass Avocado Board. About 407.9 million lbs. of the fruit were available on the date.

Hass avocado production from California was actually down drastically in the first few weeks of the year. As of the date in 2022, 26 million lbs. had originated from the state. In 2023, that number had fallen to 1.7 million. Production was likely impacted by a series of storms and floods in California caused by multiple atmospheric rivers between Dec. 31, 2022 and Jan. 25, 2023.

Chilean production decreased 254.6% during the period, with volumes amounting to 555,561 lbs. The nation is currently contending with drought and wildfires which impacted its production capacity.

Mexico remained the leading source of avocados with year-over-year production increasing 23.3% to 401.9 million lbs. The Dominican Republic posted a33.2% increase to 990,000 lbs., as well.

Avocado Exports Post Volume Drop in 2022

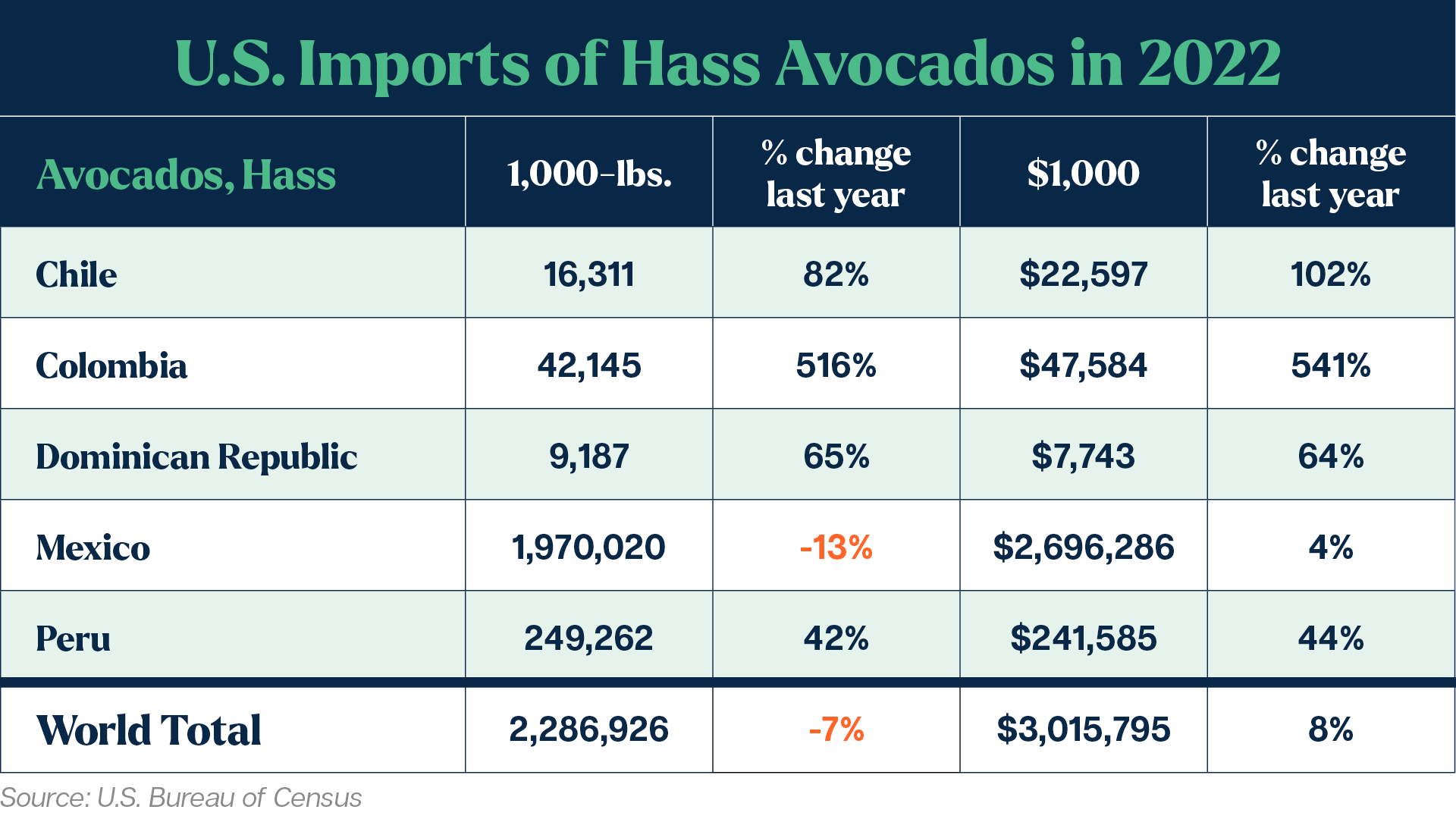

During calendar year 2022, U.S. imports of avocados dropped by 7% to 2.3 billion lbs., according to Food Institute analysis of U.S. Bureau of Census data. The decrease was largely spurred by a 13% decrease in imports of Mexican avocados, which fell to nearly 2 billion lbs.

All other countries on record posted volume gains during the year, with Colombia (+516%) and Peru (+42%) representing the lion’s share of the remaining imports.

Despite the volume drop, import value increased 8% during the year to just over $3 billion. Even with the double-digit drop, Mexico posted a 4% import value increase during the period, totaling $2.7 billion.

It’s Avocado Season All Year Long

While most people connect avocados with Cinco de Mayo, the Hass Avocado Board has worked to expand the market penetration of the product between the Super Bowl and Labor Day.

The organization recently looked at the 2022 third quarter holiday weeks. They found dollar sales increases for:

- Father’s Day Week: +14.9% to $57.5 million

- Independence Day Week: +6.5% to $56.7 million

- Labor Day Week: +10% to $49.8 million

The dollar sales increases were tied to an increasing average sales price (ASP) when compared to the 2021 holidays.

“ASP ranged from $1.62 at its highest point during Memorial Day week and softened to $1.23/unit during the Labor Day holiday. Higher ASPs impacted summer holiday sales, which drove a combined 115 million units and $164 million in retail dollar sales,” they wrote in a report.

The Food Institute Report

Editor’s note: the preceding article is an excerpt from the extensive March Food Institute report, which is available to members. To join FI, click here.