Extreme weather and supply chain issues have impacted prices for the vast majority of commodities in 2021, ranging from lumber to corn. Until recently, coffee (and avocados) seemed to be surviving in an inflationary market unscathed.

That, however, has changed of late, as the worst frost to hit Brazil’s coffee-growing region in more than 25 years is pushing prices up at a staggering pace, according to industry experts.

Brazil, the world’s largest coffee-producing country, is facing a one-two punch; the extreme frost followed a drought that had already parched the 2021-22 crop, reported The Wall Street Journal (July 27). Investors were hoping the 2022 crop would help replenish a weak 2021 crop due to the drought, but doubts are emerging.

Futures Continue to Rise on Bad Weather

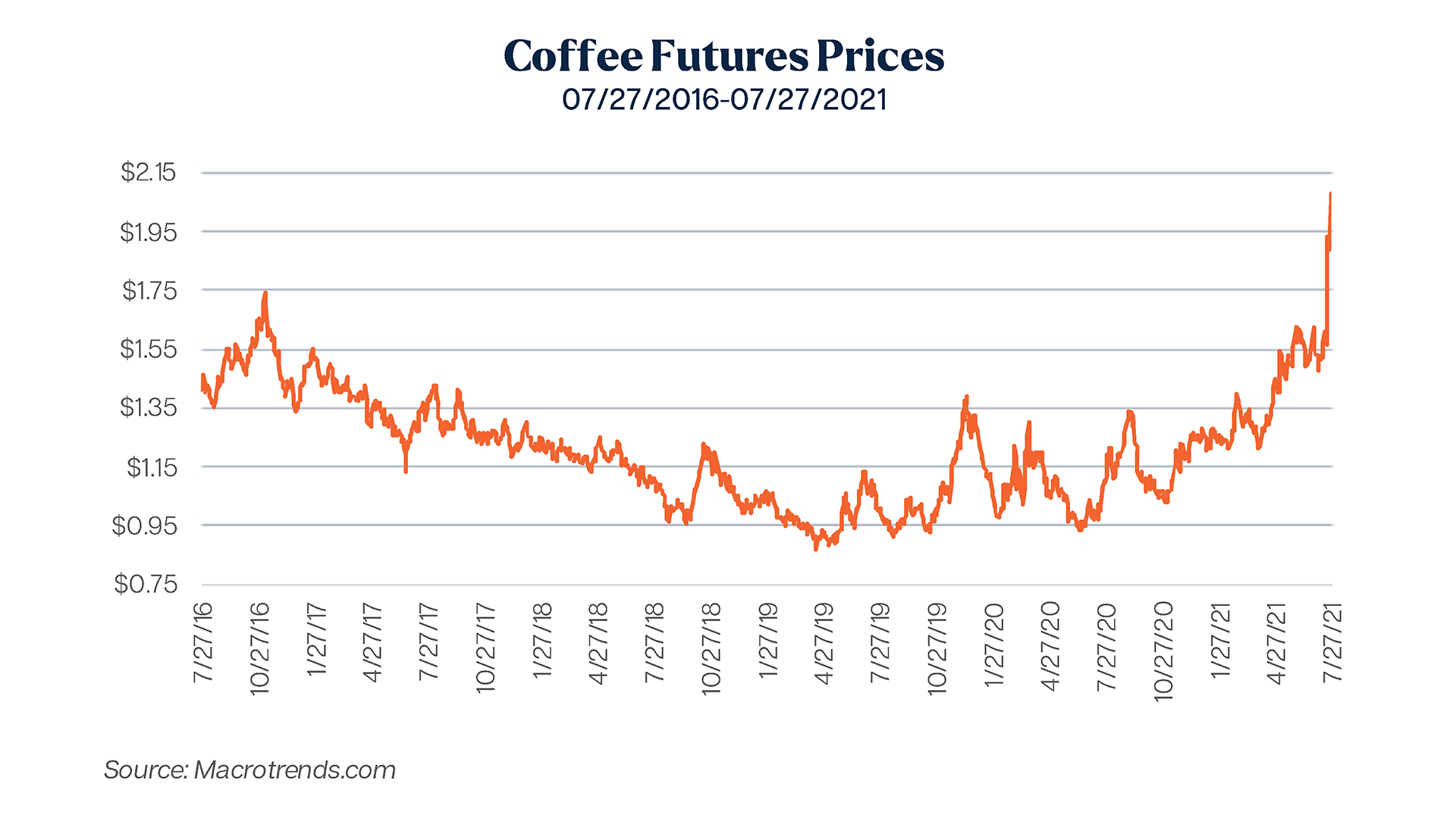

Prices for coffee futures hit a 6-year high of nearly $2.08 per lb. on July 26, up about 32% from the prior month and a staggering 91.7% from July 24, 2020, according to Macrotrends data.

Judith Ganes, president of J Ganes Consulting, noted that supplies were going to get tight because of the one-two punch, and that the “camel’s back was already broken” even before additional cold weather forecasts emerged.

“We had drought in October 2020 that caused, for the first time ever, a situation where the berries did not set after high expectations on a good flowering season. This came with high heat, too, so the crop being harvested now was compromised. Now, the frost is affecting the 2022-2023 crop, so it’s a double whammy,” Ganes told The Food Institute.

Any excess global supplies will need to be utilized to make up for the shortfall in the 2021-2022 season.

Ganes predicted prices would continue to rise over the long-term, as emergency stocks had largely been depleted since the last cold-weather event in Brazil nearly 25 years ago.

“In 1994, the last time there was a severe frost in Brazil, the country had 17 million bags of excess coffee via government-held stock to cover a shortfall. Now, they don’t have that, and U.S. stocks are already at multi-year lows. How do you rebuild global stocks with a tough Brazil crop? … My guess is it will be worse than what people are saying,” she continued.

Looking to Other Regions for Supply

Brad Rubin, an analyst at Wells Fargo, backed up Ganes’ claim regarding the state of Brazil’s crop.

“We are now in the ninth consecutive month of appreciation for coffee futures or the ‘C’ price,” said Rubin. “The production in Minas Gerais, Brazil, is predicted to be much lower because of drought conditions and rainstorms that swept through the region during bloom.

“Much of the specialty coffee Americans drink is priced higher than the C price, and are sourced from other global locations in South America, Central America and Africa. Brazil’s production in recent years has been above global demand, which is why the C price has been hovering around 15-year lows – so, the shortage could help bring the industry back into balance.”

Rubin noted that U.S. producers would likely not encounter too many issues if they looked for another supplier.

“In the U.S., processors diversify their supply with farms across various regions. Furthermore, they tend to invest in areas with resources, training, and farming best practices to ensure that supply is achieved. Most major processors in the U.S. should not run into too many challenges,” he concluded.

ICO Indicates Long-Term Trend of Increased Prices

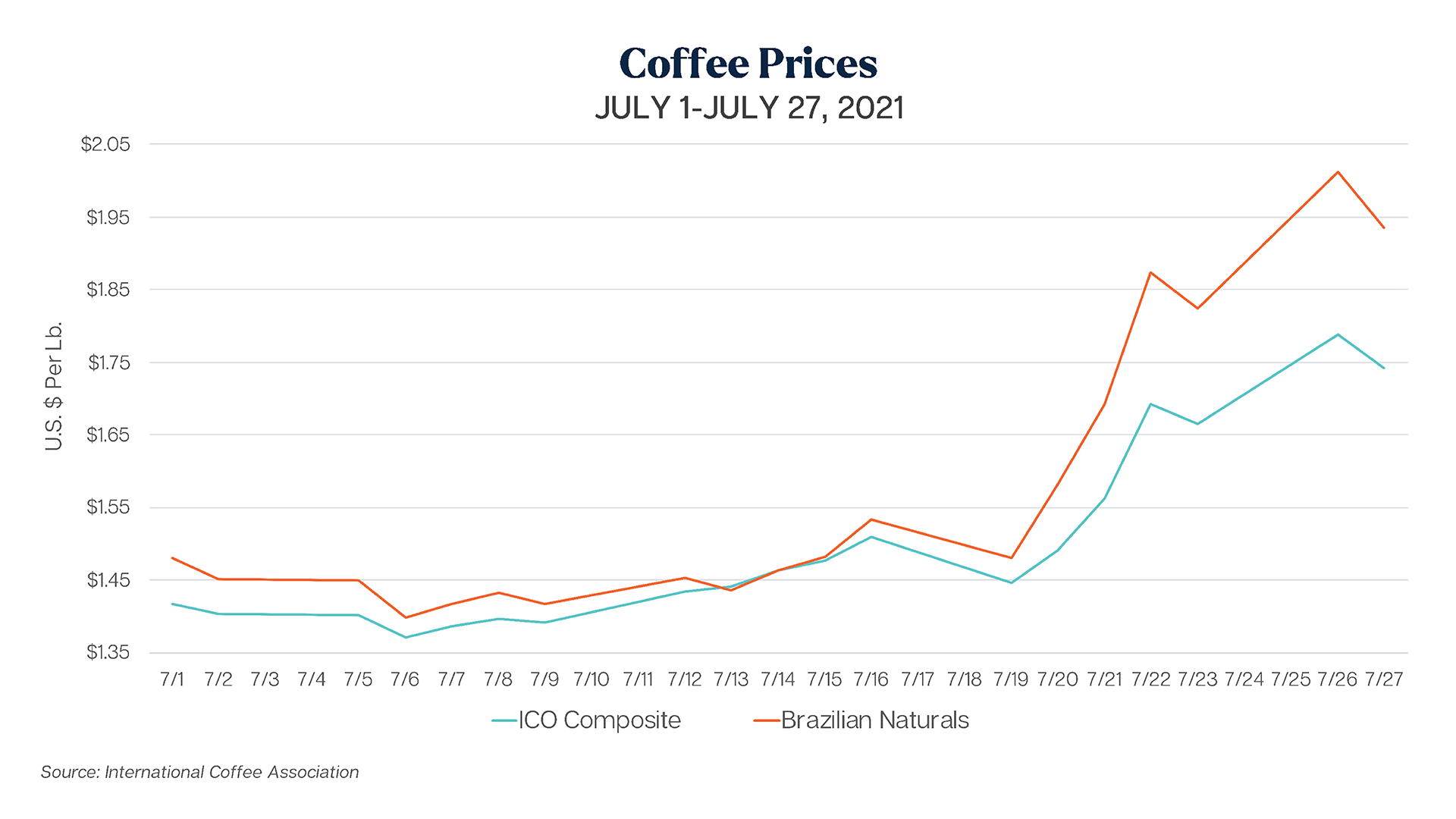

International Coffee Association (ICO) data found that prices were on the rise across the board for coffee producers. Composite prices reported by ICO (which average Colombian milds, other milds, Brazilian naturals, and Robustas) showcase a significant jump during the middle of July. The composite price jumped from a low of $1.37 per lb. on July 6 to a peak of about $1.79 per lb. on Jul 26, before landing at $1.74 per lb. on July 27.

Meanwhile, the increase in prices for Brazilian naturals outpaced the increase for the ICO composite price between July 6 and July 27. Brazilian naturals hit its low for the month July 6, as well, when prices were reported at about $1.40 per lb. By July 26, prices had jumped to $2.01 per lb., up nearly 43.6%.

ICO noted that in June, “coffee prices recorded the eighth consecutive month of increase, triggered by the expectations of reduced supply from some origins in addition to disruptions in trade flows.”

Starbucks Weighs in on the Situation

Starbucks reported earnings recently and addressed the situation in Brazil, saying it had developed a sourcing and warehousing program to help protect it against market swings. President and CEO Kevin Johnson noted the company purchases green coffee 12 to 18 months in advance and didn’t stop during the pandemic.

“So as a result, we currently have over 14 months of price forward coverage, which means we have price locked on our coverage for the next 14 months, which gets us through the rest of fiscal year ’21 and most of fiscal year ’22,” he said.

Starbucks reported third quarter consolidated net revenues were up 78% to a record $7.5 billion. Same-store sales were up 73% globally, and up 83% in the U.S.