In 2022, consumers have a growing thirst for functional beverages.

The global functional beverage market size was estimated at nearly $120 billion (USD) in 2021 and, according to researchandmarket.com, is projected to grow at a compound annual growth rate of 10.49%, reaching $198.1 billion by 2026.

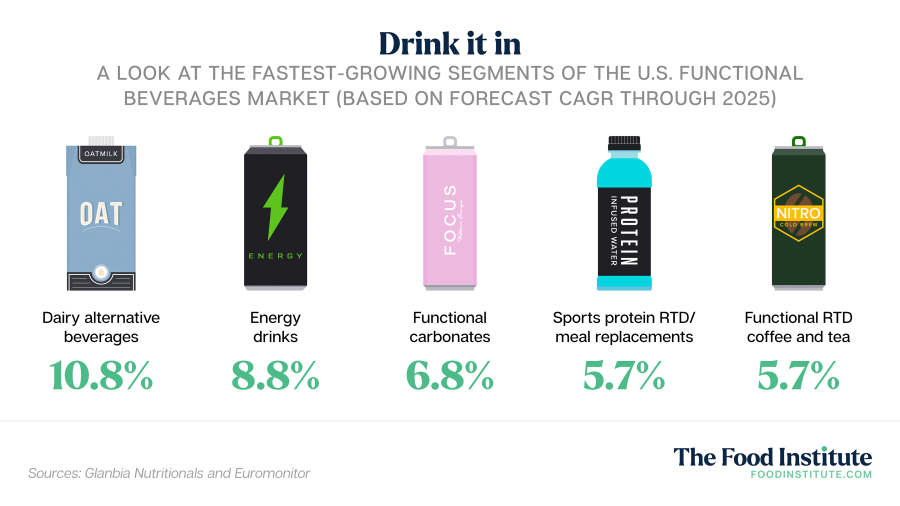

Energy drinks? Dairy alternative beverages? Americans, especially, seemingly can’t get enough of them right now.

“With functional nutritional beverages, they’re very innovative, and there’s a lot of really amazingly positioned brands coming to the market,” said Shannon Coco, a strategic marketing director at Kerry, during her company’s webinar on Wednesday, which offered advice to growing food and beverage brands.

“Nutrition and lifestyle needs – as we know in hearing from customers and their motivations – are more critical than ever,” Coco added.

In the U.S. alone, the country’s $48.4 billion functional beverage market is forecast to grow at a CAGR of 6.6% through 2025, according to Euromonitor. Energy drinks make up the largest share of the U.S. functional beverage market at an estimated $18.6 billion, followed by sports drinks at $10.4 billion.

Functional beverages marketed to highlight supposed health benefits have risen in prominence recently, with the category’s sales increasing by almost 16% between November 2020 and November 2021, according to data firm Spins, as consumers take their health and wellness as serious as ever.

Chad Willis, the CEO of Wyoming-based Plus Brand Industries, leads a company that offers functional beverages like alkaline water. He recently told Progressive Grocer that beverage companies appear likely to place an increased focus on functional beverages for the foreseeable future.

“Over the last five years, people have become really smart to nutrition and what they’re putting into their body,” Willis said. “They really like to know that they’re putting something good in their body.

“You’ve got the big companies buying up bottled-water and functional-beverage companies,” Willis told Progressive Grocer. “These things are going to continue to happen because of consumer awareness.”